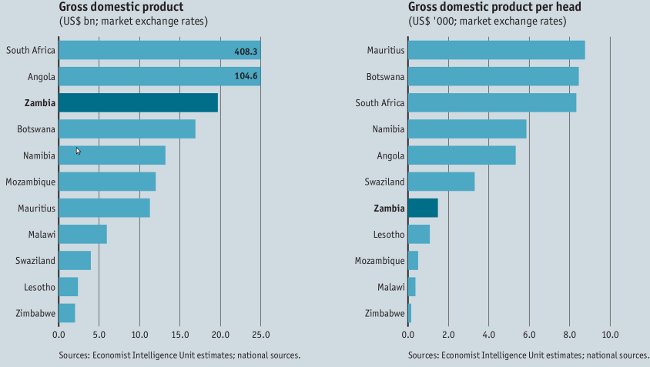

Economist Intelligence Unit published their outlook report on Zambia during the month of may. Below are some extracts from the report for their outlook for the period from 2012 to 2016

Political outlook

Political stability

President Michael Sata’s victory, which ended two decades of rule by the Movement for Multiparty Democracy (MMD), was underpinned by the perception that economic growth under the MMD largely benefited the political elite and foreign investors.

His first term is, therefore, likely to be dominated by three issues, namely Tackling corruption,Redistributing wealth and Cutting unemployment.

The PF’s parliamentary representation is set to grow slightly, as the party has had some success in its appeal against the election results in constituencies that were won by the MMD. The government attempted to deregister the MMD, on highly questionable grounds. Our core scenario is that the courts will block this or the government will back down. If not, political checks and balances in Zambia would be severely weakened.

[pullquote]Finally, Mr Sata’s campaign pledge to put more money in people’s pockets has raised expectations among his supporters, if there is little tangible change over the next year, urban unrest could arise.[/pullquote]

Although Mr Sata has toned down his pro-labour rhetoric,the mining sector has continued to face regular strikes over wages and working conditions. High global copper prices are likely to have been a factor in stoking discontent, and sporadic unrest is likely to continue as long as copper prices stay high.

Finally, Mr Sata’s campaign pledge to put more money in people’s pockets has raised expectations among his supporters, if there is little tangible change over the next year, urban unrest could arise.

Election Watch

The next round of elections is due in 2016. The vote is expected to be free and fair, but the run-up to voting is likely to be marred by bias in the state-owned media and the incumbents’ use of public resources to fund their campaigns.

Some election-related violence could occur but widespread violence would be unlikely—Zambia does not have a history of severe vote-rigging or incumbents ignoring election outcomes. The result of the elections will depend on whether the PF lives up to its campaign promises and whether the MMD is able to revamp its image, which has been battered by allegations of corruption.

[pullquote]Some election-related violence could occur but widespread violence would be unlikely—Zambia does not have a history of severe vote-rigging or incumbents ignoring election outcomes. [/pullquote]

The first draft of the revised constitution includes a clause changing the system for presidential elections from first-past-the-post to one in which the winning candidate would require more than 50% of the vote. If retained, this would weaken the advantages of incumbency, as a fragmented opposition would no longer guarantee victory for the ruling party. The draft also seeks to change the parliamentary vote from first-past-the-post to proportional representation; under the latter, the composition of parliament would more closely reflect voting patterns.

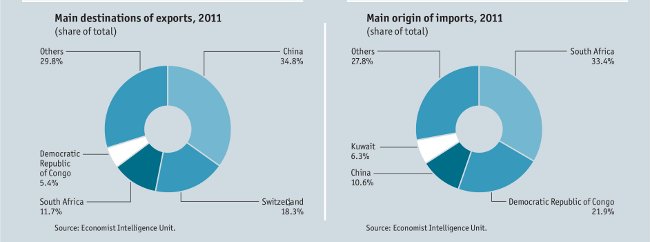

International Relations

Mr Sata, formerly a fervent critic of Chinese investors, has now softened his position substantially—an implicit recognition of China’s importance as a source of investment. Relations with Western donors could be undermined if abuses of office occurred under the new government. Zambia is expected to remain largely on good terms with other countries in the region.Mr Sata has expressed support for Zimbabwe’s president, Robert Mugabe, placing him among a number of his peers in SADC but at odds with South Africa.

Relations between Zambia and the EU are expected to sour following accusations by Mr Sata that EU diplomats have interfered in Zambia’s internal affairs. This followed a meeting between the leaders of the main opposition parties and the EU head of delegation, Gilles Hervio.

[pullquote]However, it is in line with his general approach—the president has made U-turns on a number of issues, notably relations with China and mining taxation, for the sake of expediency.[/pullquote]

The EU has not confirmed what the meeting was about, although The Post reported that it was held to discuss the suspension of the three judges. Mr Sata’s remarks are striking given that he met with several diplomats when he was in opposition, prior to his election victory in September 2011.

However, it is in line with his general approach—the president has made U-turns on a number of issues, notably relations with China and mining taxation, for the sake of expediency.

The incident is not expected to jeopardise Zambia’s access to aid. However, it does come on the back of other developments that are likely to have been of concern to donors, and aid inflows could be undermined if this trend continues. Notable among these is the ongoing attempt to deregister the largest opposition party, the Movement for Multiparty Democracy (MMD).

Economic policy outlook

Policy trends

The government is likely to strike a balance between meeting the expectations of its supporters—less inequality, better industrial regulation and lower unemployment—and sustaining investment and growth. However, there is some risk that it will introduce policies that are poorly designed or counter-productive, which would undermine growth. In line with the central scenario,it is expected to stick to a market-orientated agenda and maintain macroeconomic stability.

Recent public-sector pay increases have been well in excess of inflation, but this state of affairs is not expected to continue over the rest of the forecast period.

Drastic changes in mining policy are not expected,but some measures will be taken to boost revenue from the sector (partly by ensuring better compliance with existing tax rates) and improve working conditions.

The 2012 budget has raised mineral royalty rates from 3% to 6% for base metals and to 5% for precious minerals. Further modest increases in mining taxes could be made in 2013-16 if copper prices stay high, as the Economist Intelligence Unit forecasts. The government has also said that it will negotiate increases in its stakes in the mines to 35% (from 10-20.6% at present) and may introduce restrictions on the repatriation of export earnings.

The reaction of mining companies to these policies has been muted, and we believe that the changes are likely to be accepted, although if handled badly (if, for example, the government were to renege on its commitment to increase its stakes in the mines via negotiation rather than coercion), investment in the sector could fall.

Infrastructure will improve gradually as investments are made in power supply and roads. Power generation is expected to grow by 50% in 2012-16,reducing the frequency of power cuts but not eliminating them. The fiscal incentives on investments in the “priority sectors” have been retained but could be lowered, as the threshold of US$500,000 for eligibility means that these tend mostly to favour foreign companies. Despite high levels of public spending on education, progress in improving its quality and relevance is likely to be slow.

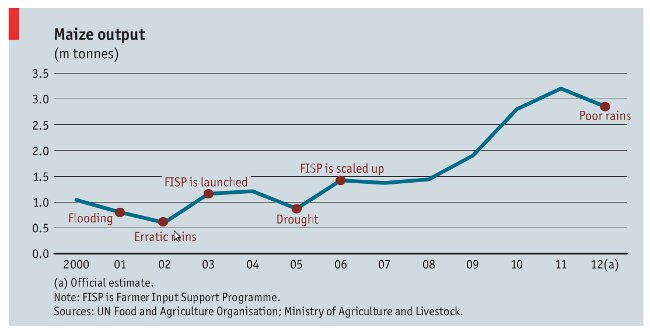

Agriculture will remain high on the government’s agenda. Fertiliser subsidies will be retained but their share of the agriculture budget is set to fall slightly.

Although the subsidy scheme has allowed maize production to rise sharply, it is flawed: targeting is poor; a blanket support scheme for maize is inappropriate given that Zambia has three agro-ecological zones, each suited to different crops; and the impact on productivity has been weak. The government has acknowledged some of these issues and agricultural policy could become more effective over the forecast period.

Public-sector workers receive large pay increases

In April the government agreed to raise basic salaries for civil servants by 4-15%, to peg housing allowances to 20% of basic salaries and to introduce a transport allowance equivalent to 10% of basic salaries. This followed hefty wage increases for public health workers earlier in the year (February 2012, Economic performance). The wage increases do not seem to have been fully budgeted for—the government initially offered civil servants a 4% increase, but this was rejected—and no details have been provided of the cost to the exchequer or the implications for the fiscal deficit.

The increases are consistent with the campaign pledge of the ruling Patriotic Front (PF) to put more money in people’s pockets, but raise questions about whether the government is capable of balancing this objective against the need to maintain macroeconomic stability.

In response to the wage increase we have revised our forecast of the fiscal deficit in 2012 from 5.9% of GDP to 6.2%; this is based on the assumption that capital spending will be lower than projected in order to counter some of the impact of the wage increase. Despite this, debt-servicing capacity is expected to stay intact, partly because the debt stock has been fairly small ever since Zambia received debt relief in 2005—it stood at an estimated 27.3% of GDP at end 2011—and partly because fiscal revenue is likely to be supported by strong economic growth.

However, if uncertainty about the direction of economic policy were to increase, undermining investor confidence, this would prompt a revision to our outlook for sovereign creditworthiness.

Fiscal policy

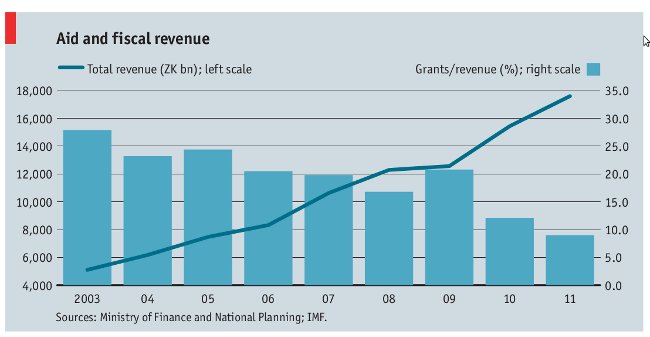

Fiscal policy will be expansionary in 2012-13. The government projects the deficit at 5.6% in 2012 as expenditure grows by 30% while domestic revenue and grants grow by 25% and 19% respectively. Expenditure overruns are likely following the recent hefty wage increases for civil servants and public-sector health workers, although we expect that this will be partly offset by lower than budgeted capital spending. Overall, we forecast a deficit of 6.2% of GDP (previously 5.9%) in 2012.

Thereafter, growth in public spending is expected to moderate, picking up slightly in the run-up to the election in 2016. Revenue growth will be robust, in line with economic trends. Grants are expected to grow steadily but to finance a smaller share of the budget (6.4% by 2016). The fiscal deficit is forecast to moderate to 2.6% of GDP by 2015, before picking up to 3.4% in 2016.

Public debt is forecast to rise from 27.3% of GDP in 2011 to 35.4% by 2016. Public debt-servicing capacity is expected to stay intact over the medium term, although a failure to invest borrowed funds wisely could undermine longer-term debt sustainability.

Monetary policy

The Bank of Zambia (BoZ, the central bank) will focus on keeping inflation within single digits. It will be helped by fairly stable global commodity prices,which will allow it to cut its benchmark interest rate slightly over the forecast period. The benchmark rate, currently set at 9%, was introduced in late March,

However, financial markets are thin and supply-side factors and monetary aggregates will remain important determinants of prices. The rebasing of the Zambian kwacha—1,000 units of the present currency would be equal to one unit of the new currency—is scheduled for 2012. The replacement of current banknotes with the new currency is to take place over a two-year transition period.

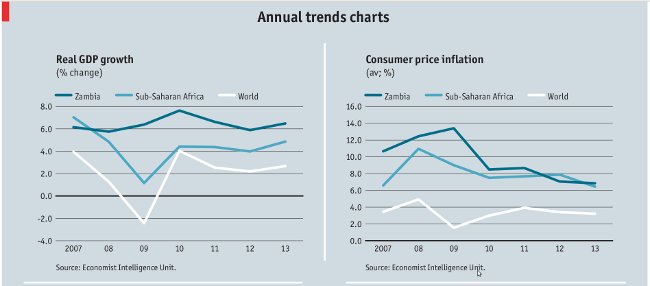

Economic growth

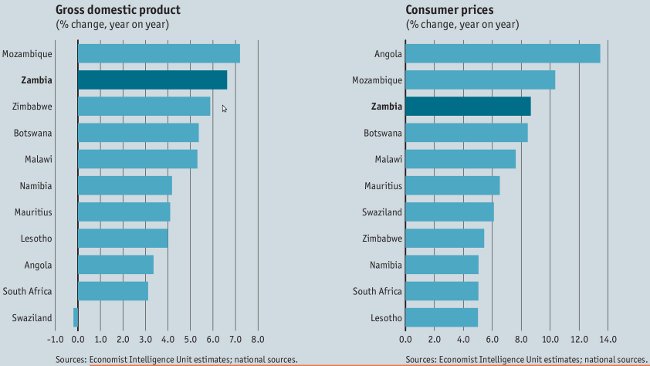

Real GDP growth is forecast to moderate to 5.9% (previously 6.3%) in 2012 as erratic rainfall damages the maize harvest. A sharper slowdown is not expected because of investments in power and mining and rapid growth in public spending.

Growth is expected to increase to an average of 6.9% in m2013-16. The main drivers will be agriculture, construction and mining. Agricultural growth will be underpinned by a public-spending push, the recent reduction in the corporate tax rate in the sector from 15% to 10% and the potential offered by Zambia’s vast tracts of uncultivated arable land and abundant fresh water.

Growth in mining will soar in 2014-15 as investments at the Kansanshi, Lumwana and Konkola mines, as well as First Quantum’s new Trident mine, approach completion. Our forecast allows for delays in these projects, and growth would be higher if they were completed on time.

Construction growth is expected to average 12.5% in 2012-14, driven primarily by planned investments in mining and power, and to edge down after that to 7% in 2016 as mining investment subsides after a period of strong growth. Services and manufacturing (which consists mainly of agro-processing) are expected to grow at an average of 5.9% per year.

The former will be driven by telecommunications, financial services, retail and the public sector, and the latter by copper output, investments in the multi-facility economic zones (MFEZs) and financial incentives for investment in the priority sectors. Growth would be lower in the event of a drought, if the incidence of strikes were to escalate, if the euro zone were to collapse or if the incidence of politicised decision-making were to increase, deterring investors.

Zambia still exports maize even as bad weather cuts yield

Zambia’s output of the staple food, maize, is expected to decline by 11%, from 3.2m tonnes in 2011 to 2.85m tonnes in 2012, according to the minister of agriculture and livestock, Emmanuel Chenda. It will, however, continue to exceed the domestic consumption requirement of roughly 2.6m tonnes.

This will help to keep domestic food prices in check, although the continued rise in global oil prices in 2012 will raise the cost of transporting food from surplus regions to deficit regions, putting some pressure on prices. The decline in production has been driven primarily by poor rainfall—maize cultivation in Zambia remains largely rainfed.

It is also due to a 34% decline in the area of land cultivated with maize by commercial farmers, although this will have been less significant, as commercial farmers account for only about 20% of maize production. Official data indicate that commercial farmers have been shifting towards more lucrative crops such as cotton, production of which is expected to rise by 122% to 269,502 tonnes in 2012, and soya beans, whose output is expected to increase by 74% to 203,038 tonnes.

Inflation

Inflation averaged 8.7% in 2011 as production of the staple food, maize, vastly exceeded domestic demand, keeping food prices in check, but fuel and electricity prices soared. Domestic maize production will continue to exceed demand, keeping food prices fairly stable.

However, expansionary fiscal policy and further rises in electricity tariffs will stoke inflation in 2012. In 2013-15 inflation is expected to ease as growth in electricity prices slows (following large increases in previous years as tariffs were raised towards cost-recovery levels) and fiscal policy is tightened. It is expected to pick up in 2016 as public spending growth increases in the run-up to the election.

In March we revised our inflation forecasts following the adoption of a rebased consumer price index (CPI). The new CPI is based on consumption patterns in 2002/03, compared with 1994 previously. As expected, food’s share of consumption has declined, from 57% to 53%, as income levels have increased. Food inflation is lower than non-food inflation—a trend that is set to continue—so the new weights will tend to boost inflation estimates.

This effect will, however, be offset by the “formula effect” of using geometric means to calculate item indices instead of arithmetic means—the former incorporates the impact of price changes on consumption patterns. The net effect will be to lower inflation estimates.

In line with this, we forecast inflation at 7.1% in 2012 and at an average of 7% in 2013-16. Further modest revisions are likely as the impact of the new formula—which varies in line with the dispersion of price changes—becomes clearer.

Exchange rates

The kwacha’s value will be supported by strong growth in copper production (particularly in 2014-16), large foreign investment inflows and high public external borrowing. This will be offset by robust import demand, a stronger US dollar and slower growth in copper prices.

Overall, the kwacha is forecast to depreciate by 10% to ZK5,345:US$1 in 2012 as uncertainty about global economic prospects and domestic policy undermine confidence in the currency, and more gradually, to ZK6,274:US$1 by 2016, as copper exports rise sharply following the completion of major mining projects.

The dominance of copper in the export basket will continue to expose the currency to external shocks. The planned rebasing of the kwacha will alter the value of our forecasts—for example, from ZK5,642:US$1 to ZK5.64:US$1 for 2013—although their substance would remain unchanged.

External sector

The current account is forecast to return to deficit, of 3% of GDP in 2012 and 2.8% of GDP in 2013, as growth in the production of copper (which accounts for more than 80% of exports) slows while imports continue to grow robustly, supported by high domestic demand and investment.

Thereafter, the deficit is forecast to decline, with the current account going into modest surplus in 2015-16 as exports increase by over 50%. This will be driven mainly by a sharp rise in copper production as major mining projects are completed, but also by modest growth in copper prices and slightly higher non-traditional exports.

The services deficit is forecast to widen as growth in tourism is outweighed by a rise in services debits (in line with goods imports). The income deficit is expected to grow steadily as profits at the mines rise, boosting income debits. Transfer inflows are forecast to increase in line with aid, but will remain small and will have little impact on trends in the current account.

Am very very proud of my party MMD, just how we managed to turn the economy of this country as shown by all the indicators above, you name it , foreign reserves, maize output, inflation..all of them trending in the positive direction. I hope the dip all indicators are showing is not a trend in the opposite direction but just a blip and PF , See you in 2016 and I hope the trend continues for the good of Zambia.

The improvements (all of them on paper by the way) were due to the improving demand and price of copper and related metals on the world market, particularly the Chinese industries.

MMD had NOTHING – ZERO – NADA – ZILCH to do with this increased demand and price of copper, so please don’t go facking insulting our intelligence by taking credit for something you had nothing to do with. You are so desperate I would not be surprised if you and MMD started taking credit for the sun shining and claiming it shines through your smelly arses.

And to add insult to injury, MMD failed to translate the paper improvements in the economy to something the common Zambian could benefit from. You were too busy dressing tress with chitenje materials when people had no food or jobs. Farking idio+s

This is indeed a very lovely report, its going into the Archieves. It is the baseline on which the PF Government will be assessed after 5 years. Great report.

Big job ahead for the PF to try to keep up with the MMD performance (Sorry Banda MMD).

“……..it is in line with his general approach—the president has made U-turns on a number of issues, notably relations with China and mining taxation, for the sake of expediency.”

Worth takeing note of.

How i miss levy’s MMD!

MMD set the standards PF has to keep them plus addressing youth unemployment

The paper has a lot of substance. In any case, the indicators mentioned therein are not very bad as it is a common trend around the world especially Europe and USA who are the largest consumers of our copper, to have a slow in economy in these years. Many economies in Europe, USA and Asia are moving slowly until such a time that the debt crisis would be sorted out.

Good point copperbullet. PF must keep the good standards set by the defunct MMD. Not the way MMD scrapped off all UNIP achievements.

PF has not drastically changed the Policies of the MMD and am sure they will continue with the positive developments.The PF Government is also trying to remove corruption in the country.All Economic Parameters indicate that the country is moving in the right direction.

Dollar

It is NOT MMD’s pervformance, but the rise of China’s demand for copper. MMD rode on high copper prices – so don’t fool yourselves!! Instead of diversifying the economy using the proceeds from high copper prices, MMD put it in their own pockets or buried it in the ground. The biggest shame is on MMD

Reveneue from copper does not go back to Zambia. So despite the high copper prices, Zambia has not benefited enough.

So Zambia and MMD presided over high copper production, not necessarily high copper prices. LOL

At work was Magande and LPM. It seems their shoes have been too big to step in.

…and thats the issue!

Good report,keep doing a Good job guys,dont turn political also with misleading statistics,so far so good.PF is aware of these good successes and they will rise to the challenge.I give Credit to FTJ he laid a good base not levy or RB.Sata will make workers proud and preserve the little natural endowment from being sold to racists.

PF need to wake up otherwise we have made huge steps backwards, back in the black en white TV era instead of streaming to 3D TV

This is unbiased report on the happenings in Zambia i recommend it before i start my EURO win !!!

Mind you, this is the same outfit that predicted that Rupiah Banda would win the 2011 elections. As for winning the Euro, best of luck mate.

|t is a very objective and substantive report. Hon Alex. B. Chikwanda minister of finance has to put his team to work to ensure that PF keeps the trend on and improve on other areas. It is absolutely necessary to have a better GDP per head with improved job creation and better wages. The inflation will not be affected by the above if it is trully representative of productivity of the economy in mining, manufacturing, construction & agriculture. In 2013 there will be jobs created from construction of ring roads in Lusaka by RDA and re-construction of inner city roads by the mines as already proposed to the PF government. ZESCO and private partnership construction for more hdro-power generation plants from 2013 to 2016 will be another source of jobs. PF will come out good by 2016!

Sata cantt understand that report. Neither his nephew GBM. dont bring complex issues leaving Donchi Kubeba slogan

Good report.

But public sector pay rises raise serious questions. We could be subsidising consumption there, which KK used to do. That money could be borrowed. Perhaps better to spend it on constructing new schools and hospitals.

#12 Kangwine

Spot on there. Zambia owes it to FTJ for setting the foundation. The structural change was painful but it had to be done. Moving from an economy 80% state controlled to where we are now, where most of the economy is privately run has improved effeiciency and productivity in our economy. Successful debt cancellation under HIPC, pushed by FTJ and concluded by LPM also removed the huge yoke of debt that empoverished us. Before that we spent more money on paying interest on teh debt than we spend on health and education combined. Now we are free of that $6 bn debt we all learned about in Civics.

Zambia’s future is bright. We thank God for FTJ and LPM.

A well researched report touching on major issues.Worrying,though, is the forecast depreciation of the kwacha and the increasing public debt used mainly to finance pay raises.Common sense dictates that you borrow to invest and not to finance consumption.Also the PF’s penchant for political grandstanding may yet scuttle some of this forecast as the PF tends to shoot themselves in the foot with no regard for investor confidence implications.

words are cheap and deeds are dear. PF is full of nothing but words. Time to do things, only to realize Dochi Kubeba is not a policy which can give good results but corruption and protecting the corrupt.

Guys I want to hide. This is embarassing. Did the delegation know that he is the Presidnt? Anything we can do to say that the president didnt attend and that the one who spoke was concerned Zambian citizen from Mukuni village?

WHAT IS ZAMBIA KNOWN FOR? I DON’T MEAN NATURAL THINGS LIKE WATER, TREES AND COPPER. NOT EVEN POLITICS, SUCH AS LIBERATION OF AFRICA. I MEAN, IN THIS COMPETITIVE WORLD WHAT DOES IT MEAN WHEN ONE SAYS I AM A PROUD ZAMBIAN? ANY INNOVATIONS? WHERE ARE “CLEVER” OUR SCIENTISTS, ENGINEERS?

Good report and we wait to see how PF is going to perform till 2016. So far so good.

I think we can even do better. Infrastructure improvements can spur economic growth. The newly created districts will be busting with construction activity, creating a considerable number of jobs. Let gas explorations yield other fields of investment. Let’s expand agro processing and improve on tourism inflows. YES WE CAN do even better!

The PF have been clever not to shift economic policy fundamentals. So we are talking CONTINUITY WITH CHANGE. OK, so the economic intelligence unit have spoken, let’s hear from Standard and Poor’s ratings…and ba Fitch kekekekekeke. Let us work guys. I am sure ABC has read this. Ba Guy Scott, Lubinda, Yaluma, Bob, Chenda etc. We are also talking roads linking provinces, university constructions etc

Very good detailed report is there any way of downloading it?

Pf cadres are finding it difficult to accept this report. My advice to you is to stop fighting facts. Facts are stubborn and cannot be wished away. It is the former govt that has made the country food self sufficient. The projects underway in the country like roads, mines and power stations have all been initiated by the mmd. Pf has not initiated any single project todate except politiking.

It’s appropriate time to make a few plans for the future and it’s time to be happy. I have read this submit and if I may I want to suggest you some interesting issues or suggestions. Perhaps you could write next articles regarding this article. I want to learn more things approximately it!

Comments are closed.