Government’s efforts to shore up the national budget and boost foreign reserves remain exposed to the continued loss of taxation revenue through illicit trade and smuggling. Increased law enforcement and border controls should be a priority for stakeholders including the Ministry of Home Affairs if Zambia is to address the country’s loss of revenue resulting from a drop in copper prices among other factors.

According to the Tobacco Institute of Southern Africa (TISA), so profitable is the illicit trade that tobacco products are the world’s most widely smuggled legal product today. The illicit trade in tobacco products is a multi-billion-dollar business, fuelling organised crime and corruption, as well as robbing governments of much-needed tax money.

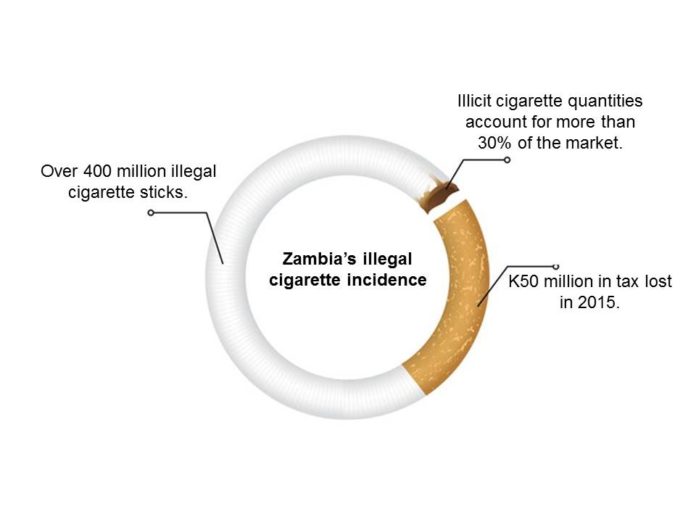

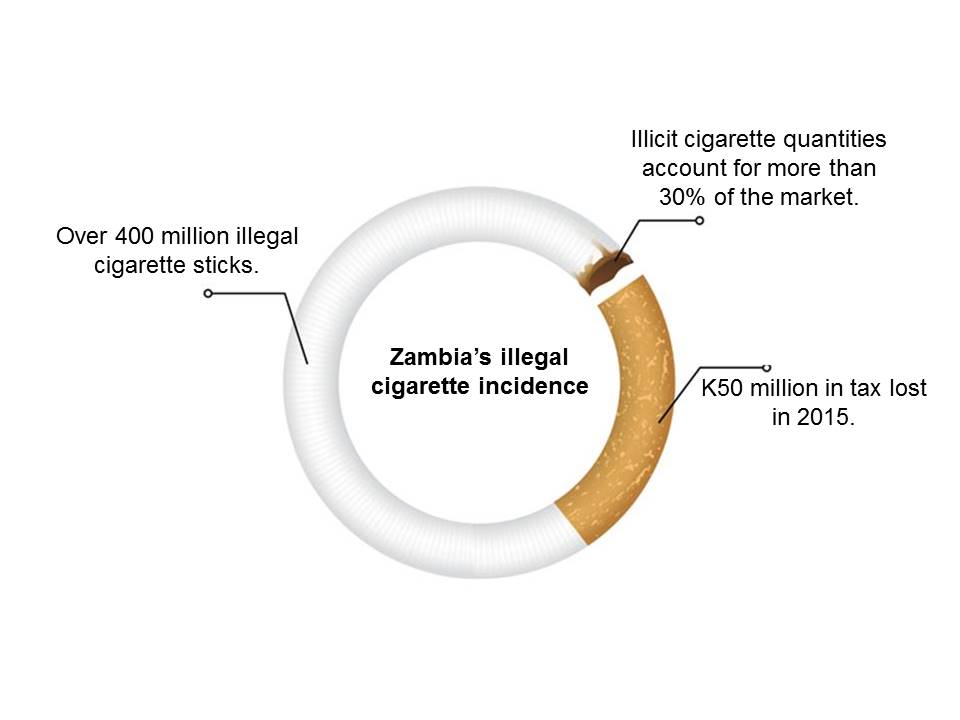

In Zambia, more than 400 million cigarettes a year enter the market illicitly smuggled, counterfeited or tax-evaded, accounting for 30% of the product on the market. Stemming the flow of illicit cigarettes on the market could help bridge the national budget deficit gap.

Estimates indicate that illegal quantities of cigarettes in Zambia account for more than 30% of the local market, translating into more than 400 million sticks per year. These non-taxed and unstamped goods are displacing the legitimate quantities on the market.

“Zambia has a 30% incident level for illicit cigarettes, costing the country upwards of K50 million in revenue last year. Cigarettes that find themselves on the market will ordinarily not have had duty paid, were concealed upon entry into the market and also through outright smuggling,” says TISA.

Recently, Finance Minister Felix Mutati noted that only Kasumbalesa border post is collecting significant revenue for the government. He noted that tolling at Kasumbalesa for imports can be replicated in Chirundu, Nakonde and Mwami. The call by the Finance Minister comes as the Zambian government moves to widen its tax base and ensure compliance for traders across various sectors.

Support for the government’s revenue collection can be through enhanced border post systems and equipping law enforcement agencies with skills and capacity to prosecute tax offenders is the practical end of commitment to boosting Zambia’s revenue.

Earlier this year, British American Tobacco (BAT) Zambia together with the Zambia Chamber of Commerce Industry (ZACCI) signed a Memorandum of Understanding (MoU) with the Drug Enforcement Commission (DEC) to improve the working conditions of DEC and ultimately to ensure successful crime prevention and prosecution.

Last year alone, Zambia lost more than K50 million due to uncollected revenue resulting from smuggled products into the country. The timeline of the MoU will be three years, during the course of which DEC will receive IT equipment and support to improve the commission’s law enforcement and prosecution for various offenses including smuggling.

All tobacco is Illicit tobacco. No tobacco is nice tobacco. ban tobacco.

Comments are closed.