by Mwatula Chiti

As a new year beckons, it would be prudent to remind ourselves about one of the most precious blessings which we have at our disposal: time. For both individuals and organisations – time is arguably the most valuable resource at our disposal. It is possible for a person to make more money and recover that which was lost in the past but it is nearly impossible to recover lost time.

Recent research by the Harvard Business Review revealed that this generation is busier than any generation preceding it. The younger demographics of this generation in particular, the millennials; are said to be less patient and more inclined towards quicker or faster solutions. It is this ‘microwave-quick’ generation that forms the majority of prospective clients for financial service providers.

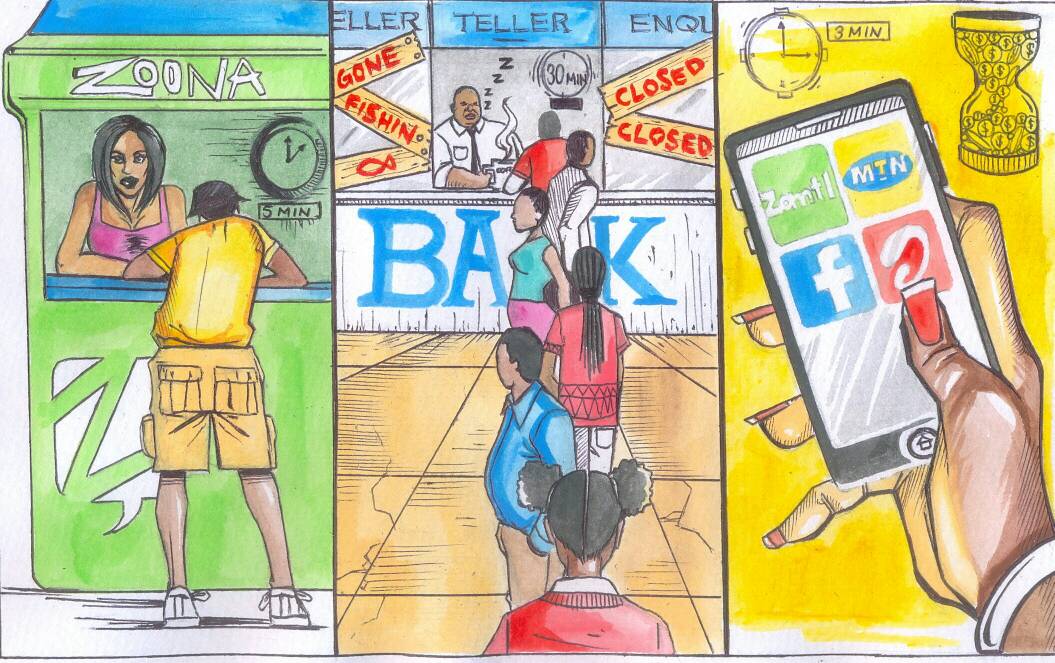

When it comes to choosing a bank or branch in which to transact, the average client’s main priority usually comes down to “which bank or branch is quicker, I would like to transact and leave as soon as possible.”

On the contrary, a number of banks in Zambia have a slow turn-around time. How often have we stepped into a branch to make a cash or cheque deposit or over the counter withdrawal and ended up spending at least half an hour in a queue. However, we cannot be too hard on our banks, they have endavoured to provide alternative pragmatic solutions such as 24 hours ATM Services. A few of our Zambian banks have introduced direct deposit service ATMs in urban areas and at major malls.

In 2017 alone, 3 of our major banks launched mobile banking applications which allow their clients to have 24 hour access to cashless money transfer services. In total 12 out of our 19 commercial banks have fully functional mobile banking applications, which is quite commendable. One can only wonder what the other 7 are still waiting for.

Having a mobile banking application is one thing, having one that works efficiently and effectively is another story. Discussions, blogs and social media comments by clients of certain banks leave much to be desired. Commentators argue that applications only work during “office hours” which almost defeats their purpose of existence. Other mobile applications are inconsistent and cause account reconciliation problems such as miss-posted transactions, miss-matching transaction reference details, erroneous debits/credits, duplicate bank charges and bouncing back of transfers. In a nutshell, some of our banks’ mobile applications make clients feel like each transaction is a gamble, leaving you guessing what will happen each time you transact. I personally remember banking with a certain bank whose mobile app could not even efficiently show me my correct account balance. Of course this is not the case with all banks, it’s just a reminder of how vast the gasp spans in terms of quality service provision depending on whom one decides to bank with.

With the advent of online scams growing rapidly, this is the last thing that any financial service provider would want; a situation where your clients settle with the notion that using your mobile app is unpredictable and at one’s own risk. Such a bad precedence has forced some people to ‘swear’ that they will never do any transaction online.

This is where the “New kids on the block” emerged and changed Zambia’s money transfer business for good. The first to join the marketplace were the mobile service providers and telecommunication companies. In 2002 Celpay, a subsidiary of Celtel, was incorporated and began offering mobile banking services. The company was later acquired by Zain and became its subsidiary. In 2010 Zain was subsequently bought by Bharti Airtel which finally rebranded to “Airtel” as we know it today.

In December 2013, then Airtel Money director Brenda Thole disclosed that the mobile money service had 1.2 million subscribers. MTN Zambia also launched mobile money services, with Zamtel only joining the bandwagon in 2017, launching a service dubbed “Zamtel Kwacha.” Next in line was the Zambia Postal Services Corporation (Zampost) which developed a new payment system called Swift cash. The newly developed payment system targeted clients in unbanked remote parts of the country and endavoured to help reduce the risk of moving large sums of money.

In my personal opinion, the real game changer was a seemingly small start up called “Zoona”; a modern day David going up against all the aforementioned more experienced and financially muscular industry giants.

Zoona was founded in Zambia in 2009 by two entrepreneurial brothers from Kitwe, Brad and Brett Magrath. The Magrath brothers wanted to address a problem major problem in the Zambian economy; providing financial services to the unbanked population.

A survey on Access and Usage of ICT in Zambia was conducted in 2015 by the Zambia Information and Communications Technology Authority (ZICTA) in collaboration with the Central Statistical Office (CSO) and the Ministry of Transport and Communications. The findings revealed that 86% of Zambians did not have bank accounts! Almost a year later, in June 2016, Lusakatimes reported then Minister of Finance, Honourable Chikwanda stating that the unbanked population had reduced to 42% due to newly enacted policies.

It is against this backdrop and startling statistics that Zoona joined the ultra-competitive mobile money market. Their target was mainly adults with limited or no access to formal financial services. They created a simple but highly efficient business model which only requires a customer’s national Identification card, mobile number and a security pin which they personally send to the beneficiary. Within a few minutes, the transaction is done and the beneficiary can collect their money from any Zoona both. The sender of the money pays a small commission which ranges from K5 to K250 or more, depending on the amount of money being sent.

By the end of 2016, approximately 1 million customers were using Zoona every 60 days, with over 1600 Zoona outlets dotted all over Zambia. Zoona reports that more than $1 billion dollars worth of mobile money transactions had been processed.

This simple looking business model has taken Zambia by storm. Bank branches are slowly getting decongested. Zoona’s clientele range from the Upper/middle class urban citizens to the part time employed low income earners.

The earlier mentioned ZICTA survey also revealed a significant increase in the number of mobile phone subscribers from 2.6 million in 2007 to 10.9 million in 2015 due to increased investment in the sub-sector by mobile service providers. Times are changing; 10.9 million potential clients now have mobile phones and access to the internet. However, not all of them are literate enough to easily navigate a complex mobile banking app, not all of them are willing to spend time filling forms and attaching the numerous mandatory KYC compliance documents. Some of them just want to urgently send money to a parent, child, relative,friend, worker, supplier and so on.

Time is money. This “fast” generation is too sophisticated for the conventional banking strategies of the yesteryears. We are too busy to spend time in a queue and yet we spend more time than ever before online. We can buy and sell online, we pay for bills online, and we send and receive money online.

The rules of engagement have changed. As an old adage says; “you cannot beat a river into submission, you must surrender to its current and use its power as your own.”

Mwa pya baisa! Aluta Continua dear banks !

By Mwatula Chiti

The author is a former Corporate Banker and currently working as a Finance Officer at the African Union Commission. He is also a Financial Analyst, Satirical Blogger and an Activist for Youth Financial Inclusion in Zambia.

Good article on Virtual and banking developments in the Zambian Financial Sector Chiti Wasambo Mobile Baking or virtue banking should be seen often at the intersection of banking ,financial services and technology It’s still to be seen how mobile money will replicate and replace the traditional and innovative activities that banks and investment firms have often engaged in ,such activities as Commercial Banking as it affects Individuals, Investment banking solutions provided by Investment firms including the custodial role in Zambia.

You have also the issue of Sustainability and well-functioning of the financial systems including oversight and how mobile money developments will…

affect those risks better than the banking system

The development and shift to mobile money platforms will also depend largely on the structure and presence of the local and foreign banking sector You now you have Regional Banks and Money Centre Banks that you basically can find at every corner of the country and town Mobile money solutions will work rapidly in places and where there is little or no presence of money center banks only regional banks and platforms or because of costs of operations money center banks have chosen to rationalize costs and also because of heavy competition with mobile solutions

You will also be talking much about consumer behavioral change…

from traditional banking practices and likings and developments in money centers and regional banking areas as advances in internet solutions and mobile banking impacts Certain banks have done exceptionally well to provide banking and custodial facilities for individuals and business alike. Now If banks do not change with the pace and innovations in FINTECH being advanced by mobile solutions to replicate in those regional and money center banking locations ,they will become surely irrelevance to their clients Then also mobile money and banks are in a competition for clients and how they respond as opposed to closing shop will be positive to them because retreating in one…

area would not be beneficial banks would need to be innovative and embrace FINTECH solutions and match the asset base of mobile companies

There is also the case of wholesale funding and consideration financial fitness to meet obligations on balance sheets in ROA and ROE of banks and mobile money

One thing that makes banks still relevant to mobile money providers and mobile money providers would move to replace the services bank often have provided and continue to differentiate ,They know their customers

Mobile providers will need a high level of KYC on their customers and not as once off small payment client Most mobile money providers seem not to offer that intimate…

solutions to clients that banks are on a long-term, in most cases act only as a payment or receiving platform

Our local regional and money center banks like Barclays fnb ,atlas mala and zanaco ,these Banks often have received deposits and managed the clients risks amongst the depositing clients Mobile money providers often will not provide that risk allocation as per these banks

Even in mobile environments ,Banking in these banks would still be as necessary even though banks would not be purely in mobile solutions

To relate the innovative solutions and developments in our local mobile and banking I often have reviewed the commonwealth bank of Austria ,credit…

agricole of France and our PESA and SAFARICOM in Kenya and Tanzania as an example.

Pesa allows you to deposit withdraw and transfer money easily between platforms and time ,similar to most money center banking operations ,saving you time and money linin in up a bank The Pesa is an example of non-bank mobile money operated platform , often with a link on the account between the Bank and the Mobile provider as people conveniently transact and make savings

If you review developments most local regional and money centre banks that incorporate the traditional banking branches have reacted and innovated mobile deposits, withdrawal and payments solutions side by side with traditional…

banking

Rationalisation and change that has occurred without embracing the traditional banking will often back fire to those banks and clients as mobile platforms longevity and sustainability as assets impair with poor risk allocation mitigation measures fail but those banks and mobile money providers that have linked well the FINTECH to traditional banking have emerged and created business either.

GOOD ARTICLE CHITI WASAMBO

Comments are closed.