By Jones K. Kasonso

The problem being investigated is the high levels of poverty in Zambian households. According to the World Factbook, published by the Central Intelligence Agency in the United States, 60.5 % of Zambian households live below the poverty line. Despite the World Bank’s classification of Zambia as a lower middle-income country based on gross national income, the nation has contracted well over $10 billion in external debt over the past 10 years and poverty levels have remained high, widespread and unchanged. In addition, reports have emerged of severe financial hardships at personal and firm levels and with serious fiscal deficits in statecraft at the country level.

At the beginning of 2018, the Minister of Finance at the time (Hon Felix Mutati) and his team were denied a $1.3 billion bailout bond by the IMF in Washington DC. Unconfirmed reports have suggested that Zambia’s external debt stock is so large that multinational financiers fear the country is highly susceptible to default. This is against the backdrop of the country’s debt forgiveness after reaching the Highly Indebted Poor Countries (HIPC) completion point under the Levy Mwanawasa government (January 2, 2002 – August 19, 2008).

The purpose of this article is to compare and rank the economic performance of Zambia against its eight neighboring countries, and present evidence of poor economic management, financial impropriety, and misapplication of resources in statecraft as contributing factors to widespread poverty in Zambian households. Comparative analysis design was selected as the research method. Comparative analysis was used because it isolates explanatory factors that enable a better understanding of the causal relationships in the production of an event, feature or relationship. This is typically achieved by introducing (or increasing) variation in the explanatory variable or variables. The strength of this type of analysis is that it introduces additional explanatory variables to show that relationships are more or less general than had been initially assumed.

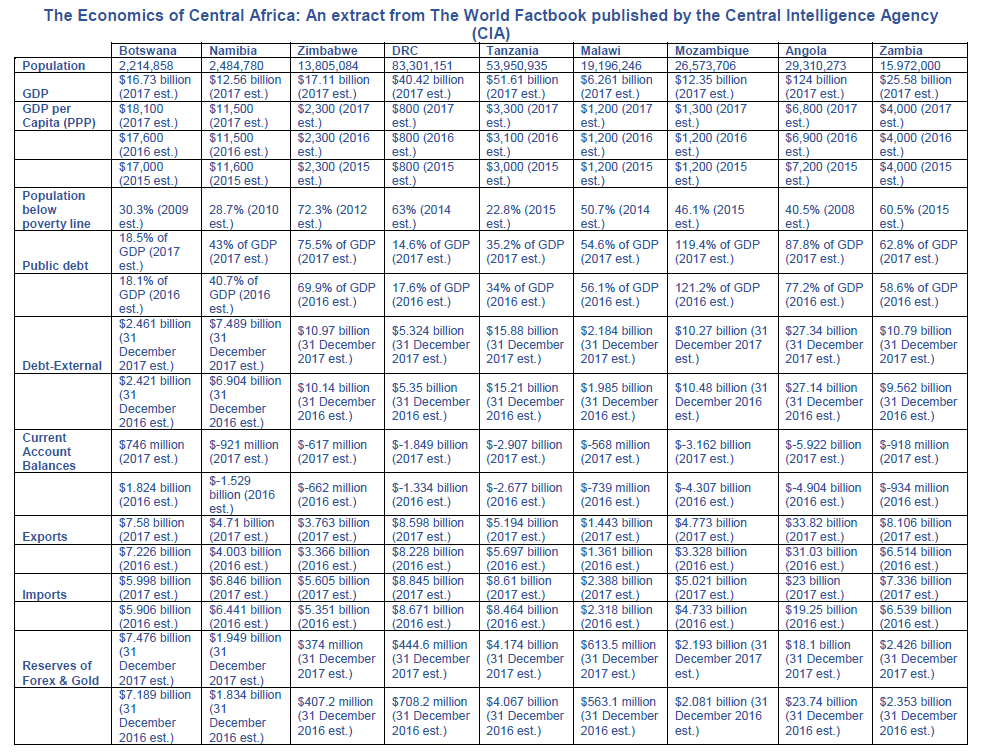

Data were collected on the key economic indicators of the Republic of Zambia, and all its neighboring countries namely Botswana, Namibia, Zimbabwe, Democratic Republic of Congo (DRC), Tanzania, Malawi, Mozambique, and Angola (see Appendix I). The key indicators included in this analysis were: population, gross domestic product (GDP), GDP per capita (PPP), population below poverty line, public debt, external debt, exports, imports, current account balances, and reserves of forex and gold. The primary sources of the data used were the World Factbook and the central banks of the respective countries. Where conflicting amounts or figures were found in the two sets of data sources, the World Factbook’s figure was used following a normal rule in financial audits that the evidence of a knowledgeable third party is more reliable than that obtained from within the entity under study. The three past complete fiscal years were used and where not available the latest information available was used in the analysis.

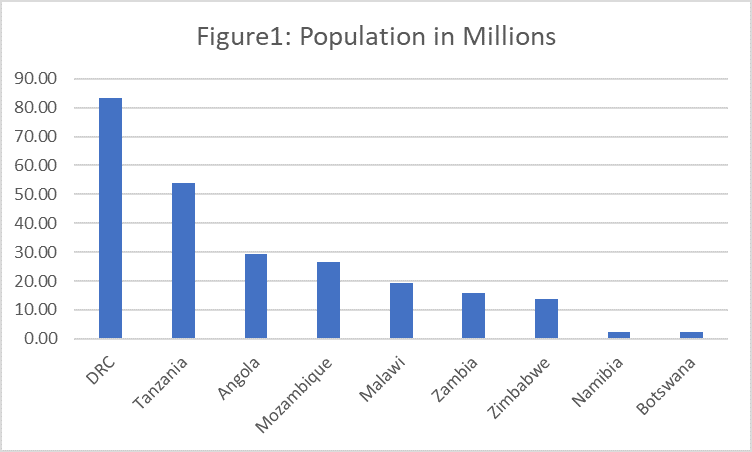

Population

In 2017, the most populous country in the sub-region by far was undoubtedly the Democratic Republic of Congo with approximately 83.3 million people followed by 53.95 million in Tanzania, and 29.31 million that lived in Angola. Mozambique was fourth with 26.57 million and Malawi fifth with 19.20 million people. Zambia ranked in the bottom four with about 15.9 million people just ahead of Zimbabwe’s 13.81 million and significantly higher than both Namibia and Botswana at 2.48 million and 2.21 million people respectively.

There are many historical and economic factors that can cause a spike or drop in the population of a country. For example, prior to sanctions and the subsequent economic meltdown, Zimbabwe enjoyed a larger population than Zambia but clearly, here the tables have turned. However, for the longest time before the period under review, Zambia has been in the bottom three in terms of population in the sub-region.

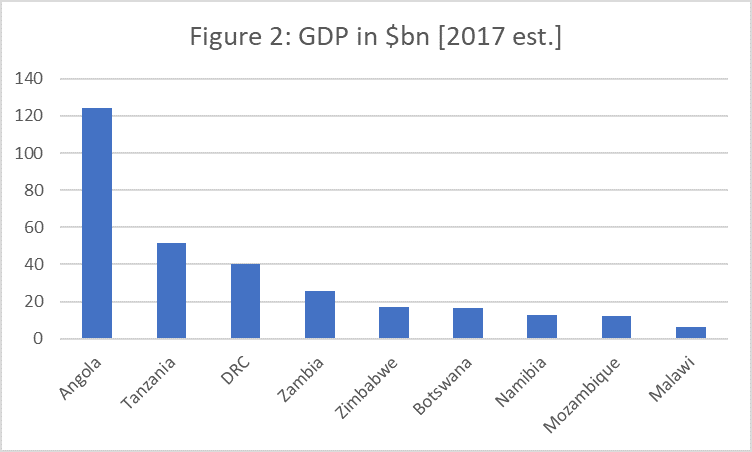

Gross Domestic Product (GDP)

The gross domestic product, GDP is the total value of goods produced and services provided in a country in a period of time. It’s a monetary measure of the market value of all final goods and services produced quarterly or annually. The nominal estimate of GDP is the generally accepted criterion for determining the economic performance of a country, and for making comparisons to other countries. In 2017 the best performing by far was Angola with $124 billion followed by Tanzania in a distant second at $51.61 billion, and the DRC in third place at $40.42 billion. Zambia was in fourth place with $25.58 billion ahead of its five neighbors: Zimbabwe ($17.11bn), Botswana ($16.73bn), Namibia ($12.56bn), Mozambique ($12.35bn), and Malawi ($6.261bn).

Clearly, from the GDP standpoint, Zambia is one of the richest countries in the sub-region. But did this incredible performance translate into a better quality of life for our people than all the nations in the bottom five? That’s the one-million-dollar question to be addressed in this article.

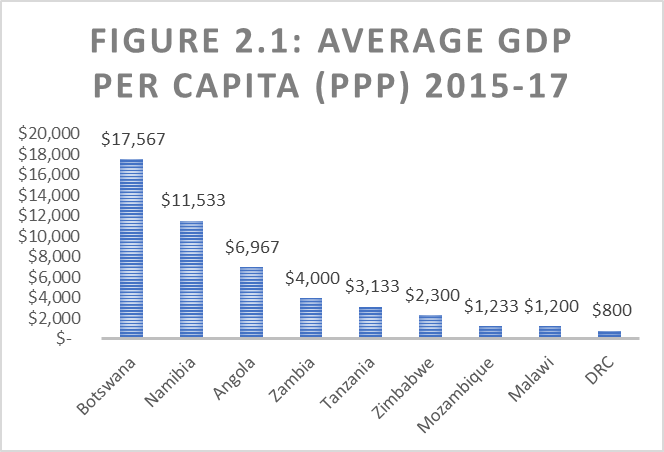

GDP per Capita

Per capita GDP is a measure that considers the population of the country to establish the output per individual residing in that country. We simply take the GDP and divide that by population to get the relative performance that we can use to compare countries. This measure is especially useful as we attempt to understand the difference in the quality of life obtaining in our country and the nations around us. However, in order to make the comparison more meaningful, the impact of the exchange rates is taken into account. The purchasing power parity (PPP), which is calculated using the “basket of goods” approach, equalizes the exchange rates to enable symmetrical comparisons. Therefore, GDP per Capita (PPP) is used in this article.

In the last three years (2015-17), the nation of Botswana topped the region with a GDP per Capita average of $17,567, followed by Namibia at $11,533 and Angola in third place at $6,967. Again, Zambia is in fourth place with $4,000 ahead of its five neighbors: Tanzania ($3,133), Zimbabwe ($2,300), Mozambique ($1,233), Malawi ($1,200), and the DRC last with $800. Clearly, from the GDP per Capita (PPP) standpoint Zambia is one of the richest countries in the sub-region.

But does this translate into a better quality of life at the personal level than all the nations in the bottom five? Perhaps a look at the proportion of the total population living below the poverty line would provide a clear picture and show the state of affairs.

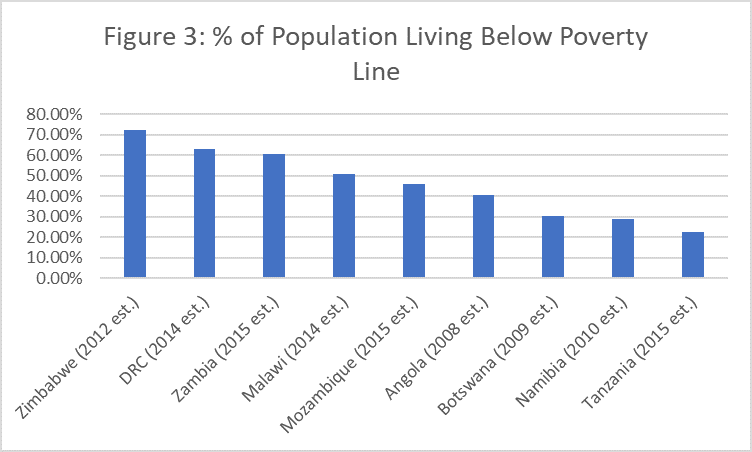

Population Below Poverty Line

In general population below poverty line is the headcount of the population that lives below the basic needs poverty line, earning less than $1 in a day. There are studies that have revised the amount to less than $1.90 a day. There are also more scientific methods such as the poverty headcount ratio among the population measured based on national (i.e. country-specific) poverty lines used by organizations like the World Bank. The scientific method considers the country-specific divisions of urban and rural poverty, dietary distinctions, and other factors. However, this method is not used for international comparison. Because of this limitation, the World Bank calculations were not used in this analysis; rather a generally accepted method of the population earning less than $1 a day was considered useful as usually, poverty in Zambia is also poverty in any one of its neighboring countries and vice versa. This analysis is based on the most recent estimates available in the World Factbook published by the Central Intelligence Agency for each country.

In the ranking of the percentage of the population living below the poverty line, Zimbabwe comes in the first at approximately 72%, followed by the Democratic Republic of Congo at 63% and Zambia

in a close third at 60.5%. Then Malawi (50.70%), Mozambique (46.10%), Angola (40.50%), Botswana (30.30%), Namibia (28.70%), and Tanzania (22.80%). Given sanctions and wars as explanatory factors for Zimbabwe and the DRC, it is probably more realistic to rank peaceful Zambia as number 1 in terms of poverty levels in the sub-region. Public debt is usually a significant contributor to high poverty levels in any country.

The Public Debt

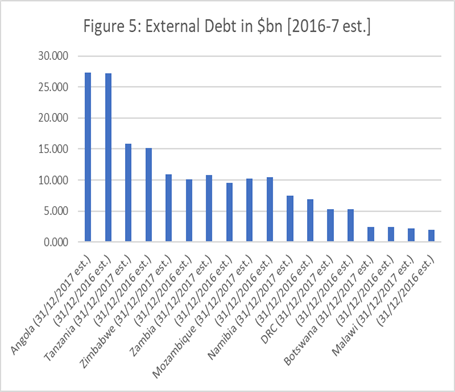

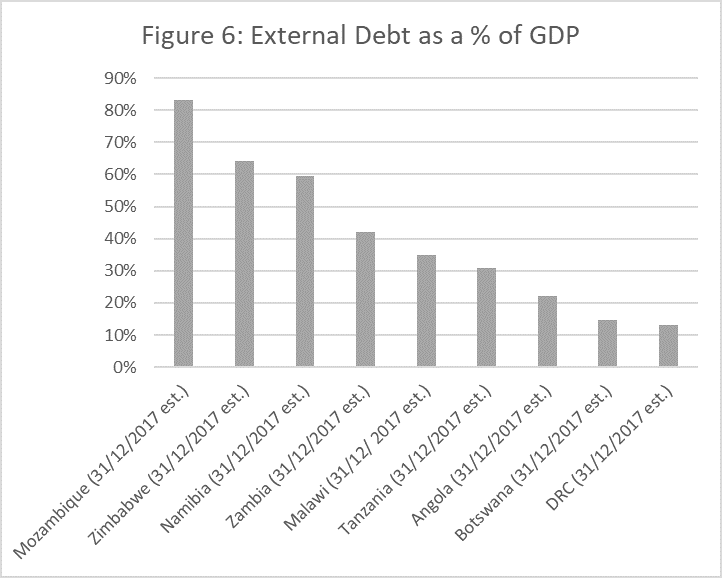

Public debt is examined here as the amount of debt can seriously constrain a government from delivering services to citizens including poverty alleviation. Ideally, the lower the public debt burden the more financial flexibility the government will have to operate and serve the needs of its citizens. The public debt also known as sovereign debt refers to amounts a government owes to lenders outside of itself. Public debt comprises internal and external debt obligations. In this article, amounts from the last two years (2016 and 2017) were used. Evaluation and ranking of each country’s debt based on public debt as a percentage of GDP (Figure 4), amount of external debt (Figure 5), and amount of external debt as a percentage of GDP (Figure 6).

Total public debt as a percentage of GDP rankings remained the same in the period under review with Mozambique as the most indebted nation in the region (2017, 119%; 2016, 121%). In the second place was Angola (2017, 88%; 2016, 77%) and in the third place was Zimbabwe (2017, 76%; 2016, 70%). Zambia is number four at 59% in 2016 rising to 63% at December 31st, 2017. Clearly, Zambia is in the top four of the most highly indebted nations in the sub-region but given Zimbabwe’s (third place) special case resulting from economic sanctions, it’s probably more realistic to rank Zambia as the third most indebted peaceful country in the region.

Similarly, the Democratic Republic of Congo’s lofty position (2017, 15%; 2016, 18%) as the country with the least amount of public debt in the region is due to its inability to secure borrowed funds because of wars. In this ranking, Botswana (2017, 19%; 2016, 18%) should probably be ranked as the least indebted country in the region, followed by Tanzania (2017, 35%; 2016, 34%), then Namibia (2017, 43%; 2016, 41%) and Malawi (2017, 55%; 2016, 56%).

Amounts of External Debt

Angola was ranked 1 with the external debt balance of $27.14 billion as at December 31, 2016, rising to $27.34 as at December 31, 2017. In second place was Tanzania with $15.21 billion as at 31st December 2016 rising to $15.88 billion at 31 December 2017. Zimbabwe ranked third slightly ahead of Zambia in fourth place and Mozambique in fifth place. Zimbabwe’s external debt balance as at December 31, 2017, was $10.970 billion up from $10.140 billion in 2016. Zambia’s external debt balance as at December 31, 2017, was $10.790 billion rising from $9.562 billion as at December 31, 2016. At December 31, 2017, Mozambique ended the year with a slightly reduced year balance of $10.270 billion from a higher prior year balance of $10.480 billion. It is noteworthy here that Zimbabwe, Mozambique, and Zambia have an identical external debt profile in actual dollar amounts borrowed. Therefore, the ending balances were used for ranking rather than an average of two years.

Further, given Zimbabwe’s international economic standoff as a unique explanatory factor for debt woes, it was more realistic to rank Zambia the peaceful country as the third most indebted in the region based on actual dollars borrowed. In actual dollars borrowed from abroad, Malawi had the lowest external debt stock balance of $2.184 billion dollars at December 31st, 2017 rising slightly from a paltry $1.985 billion balance in the prior year.

Malawi is followed by Botswana with $2.421 billion at 31st December 2016 rising slightly to $2.461 billion at 31st December 2017. The DRC had the third lowest external debt stock balance of $5.324 billion as at December 31st, 2017, from $5.350 in the prior year. Namibia was ranked fourth lowest in actual dollar amounts borrowed with the ending balances of $6.904 billion, and $7.489 billion in December 31st, 2016, and 2017 respectively.

External Debt as a Percentage of GDP

The percentage of external debt to GDP helps to show what proportion of nominal GDP is committed to lenders outside of the country. It can also be used as a benchmark to determine the countries capacity to repay borrowed funds, in addition to other obligations. Therefore, the higher this percentage, the more a country is susceptible to default. Furthermore, a lower percentage means the country is less beholden to foreign lenders and can use its resources to improve the welfare of its people through socio-economic investments. It can be used to determine the impact of foreign debt on the fiscal position of a country. A lower percentage is indicative of more responsible borrowing whereas a higher percentage is indicative of economic crisis and heavy dependence on debt.

The worst four borrowers were Mozambique, Zimbabwe, Namibia, and Zambia. Mozambique was ranked 1 with external debt comprising 83% of its GDP at December 31, 2017. In the second place was Zimbabwe with external debt comprising 64% of its GDP at December 31, 2017. Namibia ranked third ahead of Zambia in fourth place and Malawi in fifth place. Namibia’s external debt balance on December 31, 2017, was 60% of its GDP, while Zambia’s was at 42%, and Malawi’s at 35%.

The top four with the lowest external debt as a percentage of GDP were DRC (13%), Botswana (15%), Angola (22%), and Tanzania (31%). Clearly, the DRC’s lofty position is more of a consequence of the civil war than prudence in economic management, just as Zimbabwe’s worst position can be attributed to the country’s sanctions regime. Therefore, it is perhaps more realistic to rank Botswana as the best followed by Angola and Tanzania, and Zambia as one of the worst three alongside Namibia and Mozambique.

The average external debt as a percentage of GDP in the region is 40%. The majority of the nations around Zambia are at less than 36% external debt as a percentage of GDP. Since Zambia’s consistent debt profile in terms of actual dollars borrowed is identical to Mozambique and Zimbabwe (nations in serious debt-related financial difficulties), and current balance is more than the average external debt as a percentage of GDP in the region, it is perhaps understandable why the IMF would not loan $1.3 billion to Zambia which is not experiencing any crippling natural disaster.

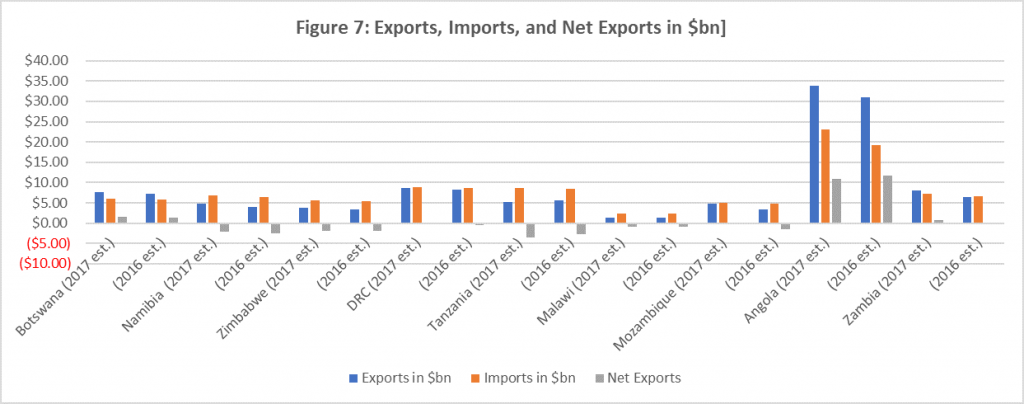

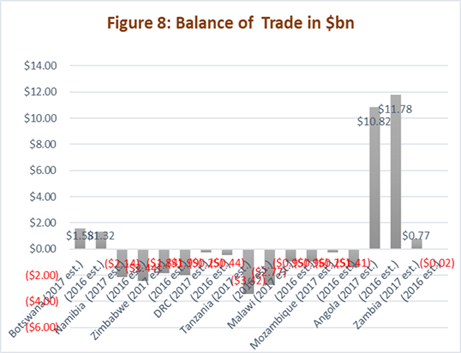

Balance of Trade

The balance of trade is defined as net exports (exports minus imports) and is influenced by all the factors that affect international trade. The balance of trade measures the net gain in monetary terms that a country is generating from its trading partners abroad. The factors that impact net exports are endowments and productivity, trade policy, exchange rates, foreign currency reserves, inflation, and demand. In this analysis, all the nations in the region have a healthy amount of exports in various products, mainly natural resources. But whether the corresponding import regimes are constructive is a totally different issue. In aggregate, the whole region is a net importing trade area with the endemic balance of trade deficits. The implication is that most countries around Zambia are not gaining any money from the international trade activities, they are losing money.

Angola had the best balance of trade gaining $11.78 billion in 2016, and $10.82 billion in 2017. In a distant second place was Botswana with $1.32 billion in 2016 rising to $1.5 billion in 2017. Zambia was in the third place with a $20 million deficit in 2016 rising to $770 million in 2017. All the other countries including Namibia, Zimbabwe, DRC, Tanzania, Malawi, and Mozambique had trade deficits with Tanzania showing the worst performing in actual dollars. In 2016, Zambia’s exports were $6.514 billion against imports of $6.539 billion.

In 2017, Zambia’s imports were $7.336 billion against exports of $8.106 billion. In 2017, total imports from South Africa alone were $2.289 billion. Therefore, the biggest single contributor to Zambia’s weak balance of Trade is the huge trade deficit with South Africa of $ 1.623 billion in 2016, and $1.770 billion in 2017.

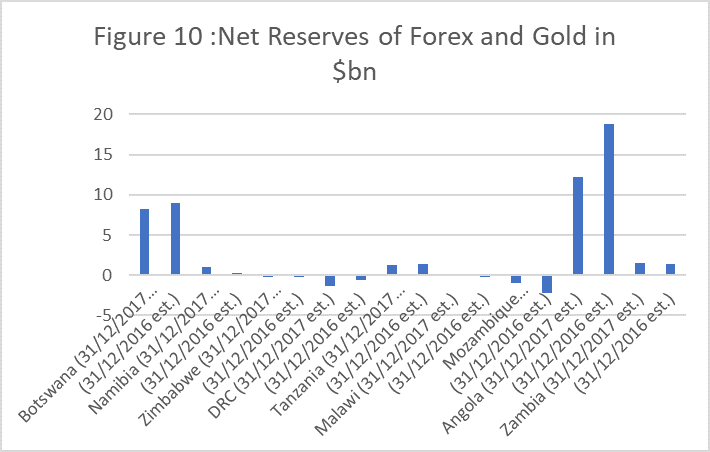

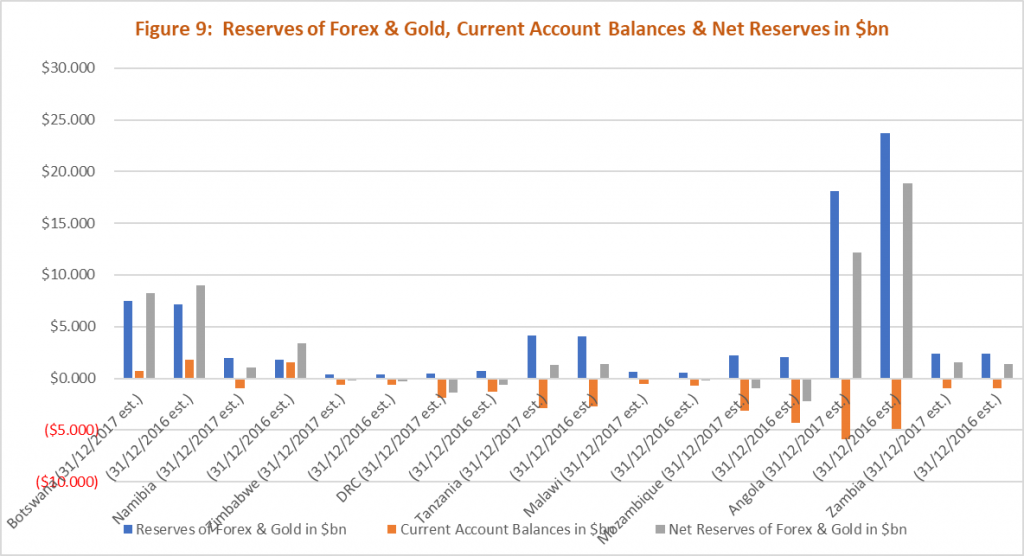

Reserves of Forex and Gold

Foreign exchange reserves are national assets held by a central bank in foreign currencies that are going to be used to back liabilities on their own issued currency and to influence monetary policy. Gold is included in these reserves because it can be sold quickly as well as used in exchange to pay for international liabilities. When we hear of borrowing from the IMF, it’s in these reserves that those funds will be kept. Foreign exchange reserves comprise bank deposits, foreign banknotes, treasury bills, bonds, and other government securities. A higher value of reserves ensures economic resilience and stability both in the short-term and long-term. Related to these assets is the balance of payments; the difference in total value between payments into and out of a country over a period. When the payments are higher than receipts we have deficits. The deficits show the amount of money the country is losing to other countries. If the current account balance is positive, then there was no pressure on reserves in that period. A positive balance can be added to reserves whereas a negative balance shows the extent to which the reserves were being depleted. Therefore, the metric of net reserves can be used to project the expected balance of forex and gold at the end of the subsequent year.

In this analysis, net reserves (reserves of forex and gold +/- current account balances) is used as it is a better estimate of expectations and reserves available for investment in the economy. It tenders evidence of how close the nation is to insolvency. Countries with negative current account balances are broke if these balances can only be deducted from the reserves of forex and gold. However, where the reserves are depleted the nation becomes bankrupt. Borrowing only solves this problem if the nation can secure loan funds that they can invest at a higher return than the interest payable on the borrowed funds. The results show that all the nine nations have some level of reserves of forex and gold, and all except for Botswana run deficits in the current account balances. However, in order to rank the countries, the current account balances were added to the reserves to obtain the net reserves of forex and gold and determine economic viability.

In 2016, and 2017 Angola had the largest amount of net reserves of forex and gold of $18.836 billion and $12.178 billion respectively. In the second place was Botswana with $9.013 billion in 2016 and $8.222 in 2017. In a distant third place was Zambia with $1.419 in 2016 and $1.508 in 2017. Perhaps it’s now public knowledge why the government is desperately canvassing to borrow $1.3 billion from the IMF. In 2016, the

Bank of Zambia attributed the current account balance deficits to rising interest payments on sovereign bonds and private sector external debt as well as the costs of foreign direct investments. Clearly, the nation has borrowed its way into impending bankruptcy. Tanzania was fourth with $1.390 billion in 2016 and $1.267 billion in 2017 and Namibia was fifth with net reserves of $305 million in 2016, and before rising to $1.028 in 2017. Zimbabwe, Mozambique and the DRC are already economic emergency cases with completely depleted net reserves. Malawi was in this situation as well in 2016 but managed to crawl up in 2017 with a paltry $46.00 million in net reserves.

Conclusion

In summary, Zambia is the fourth least populated country, with the fourth highest GDP and GDP per capita in the sub-region. But it ranks the highest of seven peaceful countries in household poverty and is comparable to war-torn DRC and behind highly sanctioned Zimbabwe. Zambia is among the top four highly indebted countries in the region in terms of total public debt, with a higher than average external debt as a percentage of GDP, and an external debt profile identical to Zimbabwe and Mozambique in the ending balances of actual dollars borrowed from abroad. In its balance of trade, Zambia’s high earnings in exports are almost entirely spent on imports, resulting in current account deficits, and depletion of reserves of forex and gold.

Therefore, it can be concluded that Zambia is broke because it’s among the worst managed economies in the region. In the sub-region of nine countries, Zambia is comparatively fortunate with a lower population, a higher GDP, a higher GDP per capita, and the World Bank rank as a lower middle-income country based on the gross national income index. Despite all its wealth, much-touted peace, and natural resources, the Zambian people are very unfortunate. The disconnect between the wealth of the country and welfare of its people points to serious deficits in leadership and management skills of those elected to run the country.

In layman’s language, the story of Zambia today is one of the very poor people who live in a rich country. Simply, there is a big disconnect between the wealth of the country and welfare of its people. In statecraft, this is the one problem that must be a prerogative of the government to fix but in our case, it appears it’s none of their business. If it is, where are the policies and programs to address this discrepancy in the wealth of the country and the welfare of its people? Other than lip service, I don’t see any public policy initiatives to address this from the current administration. Malawi with no minerals is ahead of us in addressing poverty and giving their people access to better conditions to live in. Mozambique, a nation totally capsized in debt, is better off than us. Angola, which hasn’t even finished removing landmines from decades of war, gives their population access to a better life at a higher rate than Zambia. Botswana, with such harsh climatic conditions, gives its people a far better lifestyle than we do. Tanzania, with a much lower GDP per capita than Zambia, has the lowest proportion of its citizens below the poverty line in the region.

Whatever we are doing, my countrymen and women, is not working. Public policy should invest more in the people to increase their capacity to participate gainfully in their own economy than burying billions in hills, landscapes, and rivers. The one-sided approach to tear the face of Zambia and impose structures everywhere which impoverished people can neither use nor contribute to maintenance is not helpful in the short-term or long-term. For example, instead of contracting debt to construct a railway line from Chipata to the Central Province which will be used by a few large-scale farmers who are already able to transport goods through the road network, invest that money in the people of Eastern and Central provinces directly to build capacity in small-scale manufacturing industries that will create jobs and increase internal entrepreneurial profit. It’s investments in the small-scale business that will generate a swirl of economic activity that can end widespread household poverty. The priority must be heavy investments in the people not just in their geography. The country must scale down on investing mufintu and increase the investments mubantu. After all, it’s the population that undertakes economic activity. An economically empowered people will develop their country.

[The author is a Zambian, an author, a Consultant and Accounting Professor in Washington DC and holds Ph.D., CPA, CGMA, MBA, BSc., NATech qualifications.]

Appendix I: An Excerpt from The World Factbook

I hate bar graphs, I give my students 55% max!!

Our poverty is acquired. It’s not god-given. We hunt for it as for hidden treasure.

“Why is Zambia broke?”

It’s because Jonathan Mutaware and his bandit PF organisation have made it their main objective to enrich themselves at Zambian’s expense and lucky for them Zambians are in a perpetual docile stupor to notice the thievery going on.

Here are sequence of blunders:-

– RB moved the functions of Ministry of Finance to State House, so he & his sons could loot $3-Billion left by Mwanawasa.

– Then Sata made a mistake of moving RDA to State House. When Willie Nsanda died, loads of cash in forex was found stashed in ceiling, mattresses, sofas, duffel bags etc. Appointment of Alexander Chkwanda was worst curse Zambia has ever had.

– Mutaware increased threshold Govt Depts could award contracts without going through ZAPPA (Tender Board). Now even a Govt director can borrow $millions loans & award tenders without going thru ZAPPA. Even 42x$42m didnt go thru ZAPPA.

With dull thugs like Mutaware & Kaizer Zulu managing the financial affairs of the country, we are doomed. As long as they’re driving Range Rovers, wearing Rolex…

CONT’D….

Rolex watches, have mall in Uganda, casinos in Lusaka mansions in Dubai, Swaziland, small girlfriends etc. then all is well.

They have perfected the art of stealing without a trace through kickbacks from awarding of tenders for Road contracts & other useless white elephant infrastructure projects whilst indebting the country with BILLIONS OF BILLIONS OF DOLLARS. The money from kickbacks does not even touch Zambian accounts. I personally have witnessed a group of ministers & group of Govt officials who flew to RSA to exchange money for a road tender.

Now 30% of budget is allocated for debt service while only 10% is for Govt operations including health & education. 60% goes to civil servants salaries.

“For example, instead of contracting debt to construct a railway line from Chipata to the Central Province which will be used by a few large-scale farmers who are already able to transport goods through the road network, invest that money in the people of Eastern and Central provinces directly to build capacity in small-scale manufacturing industries that will create jobs and increase internal entrepreneurial profit”

You got this one wrong. The rail line is not for a few farmers. It’s actually for minerals and other products to be exported cost effectively through the Nicala corridor 1000km away as opposed to the port of Durban 3000km away. Actually the World Bank has done a report on this rail line and its benefits to the regional economy including that of the people of Zambia in…

Ok let’s say for argument’s sake that Prof K is wrong about the railway line, it is not for a few farmers but for the mineral’s exports. If you read Part 4 . How much are the people of Zambia getting from the mines. Imwe guys mulifipu….mulipuna sana.You now want to contract more debt to build a railroad for the mines from which you are getting nothing? Come on drop the madness.

… the subject provinces. Read it and do not spoil your piece with wrong conclusions.

3.1.2 The viability of the Project rests primarily on the improved road conditions generating

savings to road users in the form of reduced Vehicle Operating Cost (VOC) savings and time

savings for normal, generated and diverted traffic, constituting 56% of benefits. It is also assumed

that reductions in road user cost and increased confidence in the Nacala Road Corridor as a viable

export route will result in increased production and sales of agricultural produce. The Eastern

Province is one of the most agriculturally productive provinces in Zambia and accounts for more

than 25% of the value of the country’s total agricultural production. NRCP, Phase II is the only

access point from the Province to the rest of the country. The benefits assumed resulting from this

“producer…

…surplus” are estimated at 27.4%. The road safety design measures and the road safety

awareness campaigns included in the Project are estimated to result in significant reductions in road

accidents and fatalities. The benefits from reductions in road accidents are estimated at 9%. Finally,

the benefits to the road agency consist of maintenance savings, estimated at 6.2% of total benefits

Objective piece of article with clear insights and analysis.

I have read through your Part 5 I can see remarkable improvements and incorporation of comments from part 1 2 3 and 4 your part 1 2 3 and 4 do not resonate well with the conclusion in part 5

The basis of your comparative is wrong already You started well by giving the demographics but failed to see the reasoning in NDPs across countries and the need for Human progress focusing and extrapolating the Future

I terms of African ranking and performance in the regions Zambia has performed I will respond to show you why and refer you to forward looking data that confirms that Let me read through the all 5 again

Kind of good to know we’re not the worst economically . But we’re also far from the best by a huge distance in every category

Zambia is endowed with better natural resources. There is no reason we should have been among the poorest of the poor. We can only blame it on ourselves.

We are too scared to think and reason. Our politicians would rather steal and kill than craft, for the nation, a pathway out of poverty to prosperity.

To understand why (much of) Africa is poor you must first understand why rich countries are rich.

Look @ the auto-mobile age :

– ASIA has TOYOTA, TATA, MAHINDRA, HONDA, SUZUKI, HONDA etc….

– EUROPE has MERCEDES, PEUGEOT, VOLKSWAGEN, FERRARI, BMW etc.

– AMERICAS has FORD, CHRYSLER, TESLA, FIAT etc.

– AFRICA has “Africa has spend their billions of dollars buying cars from their friends across continents”

The automobile industry showed growth in R&D ages ago, now they all just upgrading:

Now lets fast-forward to today “Friday, May 18, 2018”, we are in the informatique, mobile & communication age. lets see how the list looks like:

– ASIA has HCL, MICROMAX, XAO, SAMSUNG, LENOVO, XIAOMI, FASCONN, HTC, AIRTEL, CROMA etc.

– EUROPE has NOKIA, ORANGE, VERTU, ALCATEL, SAGEM, SIEMENS…

CONT”D…

– EUROPE has NOKIA, ORANGE, VERTU, ALCATEL, SAGEM, SIEMENS etc

– AMERICAS has APPLE, GOOGLE, FACEBOOK, FOURSQUARE, VODAFONE, BLACKBERRY, AT&T, AMAZON, EBAY, MICROSOFT, MOTOROLLA, QUORA , CISCO, HP etc.

– AFRICA we have MTN, GLO, these two being telecom, nothing invested on R&D for electronics (we consume from our friends across the other continent)

Now lets try and dissect bla blah Africa is good in Agriculture:

Lets look at a list of some famous names in the food industry:

McDONALDS, KFC, DOMINOS, PIZZAHUT, TACOS.

Chinese food, Indian food, Japanese food (Some of the famous dishes in the world)

Ever read or head of Zambian Restaurant, SA etc etc..???

Boy do we even wear cloths from ASIA, EUROPE, AMERICAS.

So we have to go by this definition and considering the…

CONT”D…

So we have to go by this definition and considering the above…Africa is not doing so good with the subject “Economics” hence “Bad Economy”.

By the way is that HH with the pool stick when he was still a BOY???

CONT”D…

– EUROPE has NOKIA, ORANGE, VERTU, ALCATEL, SAGEM, SIEMENS etc

– AMERICAS has APPLE, GOOGLE, FACEBOOK, FOURSQUARE, VODAFONE, BLACKBERRY, AT&T, AMAZON, EBAY, MICROSOFT, MOTOROLLA, QUORA , CISCO, HP etc.

– AFRICA we have MTN, GLO, these two being telecom, nothing invested on R&D for electronics (we consume from our friends across the other continent)

Now lets try and dissect bla blah Africa is good in Agriculture:

Lets look at a list of some famous names in the food industry:

McDONALDS, KFC, DOMINOS, PIZZAHUT, TACOS.

Chinese food, Indian food, Japanese food (Some of the famous dishes in the world)

Ever read or head of Zambian Restaurant, SA etc etc..???

Boy do we even wear cloths from ASIA, EUROPE, AMERICAS.

So we have to go by this definition and considering the…

CONT”D…

So we have to go by this definition and considering the above…Africa is not doing so good with the subject “Economics” hence “Bad Economy”.

By the way is that HH with the pool stick when he was still a BOY???

If Europeans could be credited to have done anything differently from us, the Africans, it was to learn to write down their thoughts, and to preserve those writings, for others to read. The mind is a powerful thing. It can develop to do great things. However, it must develop. When compared to the minds of other peoples around the world, the mind of an African hasn’t experienced any meaningful development. It’s yet to be challenged. And the main reason is that we are always in a state of re-inventing the wheel, and not the engine.

The Greeks were among those who saw early, the need, not only to think, but also to record thoughts by writing them down. They adored great thinkers. They created loyal followers who also became great thinkers. The Romans picked-up from where the Greeks had left it; later the Dutch, the English, the French and the Germans.

Imagine if Adam Smith had not written his famous book: “The Wealth of Nations.” And yet, for him to have done what he did, was because of the thoughts of others, some, his contemporaries and others, his predecessors.

Not only do Africans shy away from writing, we scarcely read, doing so only to crank for an exam.

This is an excellent article, well researched and right on point. Clearly something is amiss with our leadership credentials as compared to the region. The statistics presented here are a true reflection of what is happening on the ground. We have people with brains that can dissect issues like in this case and bring about solutions that can take this country forward. Alas we want to politic all the time. Our current situation is not good at all, unless we combine our efforts put our country first , we are headed for the ICU economically. What is going to happen if all of a sudden copper prices drop drastically? Kudos Professor, you are true son of Zambia.

Development theorists proceed rather differently. They are concerned with causes of underdevelopment. They are concerned with the causes of poverty. They are concerned with identifying linkages. They are concerned with categories of factors causing underdevelopment. They are concerned with quantifying and qualifying. They are concerned with identifying models of success. They are concerned with isolating catalysts. They are concerned with mixing ingredients. Is it governance? Is is corruption? Is conflict? Is it weather? Is it climate? Is it skills?

This approach is 20th Century third world economics. 21st Century Economies are applied economists and they are following the money trail. Not randomly applied constructs. People with money build houses, raise their kids, pay bills and go on vacations. That’s today’s economics follow the money. It’s the centerpiece of all economic activities. With money in your bank account as a person or country , you can do big things. You can’t develop pankongole…ubo nibusakala nyongo!

How bewitched, our minds, by those fetishes scientists call “facts!” In this body of knowledge called “economics,” how quickly we come to a nagging realization that it cannot adequately be expressed in numbers and equations!

Time to keep away from tarnishing our great country Zambia and go and live in Chief Mukuni’s village.

It’s poor economic management of our country that is tarnishing the image of our country. How can government borrow to these levels and still poverty remain at 60.5%. Which great nation borrows to this level and remains GREAT? You go and live Kwa Chipulukusu in Ndola and feel the daily struggles of our people, then you will know these writings don’t come from a happy camper!

The Ranking is as follows in accordance with human development Index framework as per UNDP with economic and performance Indicators from World bank and IMF with particular refrence to the World Bank April 2018 African Pulse Other Sources are simply comfirming performance by 3 here including the International futures data base

Basically the criteria to assess progress being made among st the countries is the UNDP development Index as per list I outlined in part 4 I will not repeat the tables anaalysing and commenting on the same by the writer because of space but It all comes to Human development index as per list i showed on part 4 ,projecting the future economic prospects from…

from the tipping point

i indicated and as per world bank pulse april 2018.You can review the MOF or BOZ or IMF and OEDC data base and see how Zambia has fairly performed on its economic indicators among st its peers , with a forward looking approach as it Invests.The debt contracted has gone towards marking the country more attractive as seen in the positive movement in the quality,easy of doing business and mobility index etc by Investing communities see the sentiments including the See the world economic forum country likeness

The writer has also missed the definition the definition of Solvency as properly applied Zambia given the global economic prospects presented to Zambia Zambia with…

The forward looking approach is fictitious it does not exist. The current account balance deficits lead to insolvency. Zambia is in deficits of close to $1 bn in 2016, and 2017. What future can you project from a broke bank account? You can’t manage the economy poorly and go to the IMF to bail you out. Challenge the author’s numbers with your sources. Just mentioning MOF or BOZ OECD won’t cut. What are their calculations? Why haven’t they updated their figures in the CIA World Factbook? Numbers don’t lie. You can steal and lie to the people of Zambia but the numbers in global databases will always present the facts. Anybody who takes his Appendix and calculates the same economic indicators will arrive at the same figures and reach the same conclusion as his! Professor Kasonso is…

its resources cannot be said to be insolvent

The ranking is as follows though Zambia is better in terms income distribution that the best 2

1. Botswana

2. Namibia

3. Zambia

4 Angola

5 Tanzania

6. Zimbabwe

7. Malawi

For further review on how Zambia has positioned itself towards the future SEE THE PADEE CENTER FOR INTERNATIONAL FUTURES PATTERNS OF POTENTIAL HUMAN PROGRESS VOLUME 1 AND READ TO SEE THE WAY COUNTRIES ARE FORECASTING TO PROGRESS

This ranking is both stupid and untruthful. How can Zambia with $25 billions in GDP and poverty at 61% rank higher than Angola with $124 billion in GDP and a much lower poverty level? is economics in Zambia also being understood like magic? it’s either dead heads are running the country in magic tricks or you guys should stop reading whatever trash you are reading to run the country!

I short the writer must have concluded to refer to the HDI Countries are at different ranking and stage so to blanket conclude on narrow selected criteria might be misleading Forinstance countries on macro could be seen to perform yet on firm level might be poorly ranked A holist and comprehensive approach extrapolating the future is better

Zambia has performed if did not i was going to say so comparatively and affirmatively

Yes according to the CPIA report ,individual central banks and IMF article 5 reports , Economic management has been ranked poorly ranked yet fairly performed among st the population of countries you have singled

Officially recalled I end here and napyamo till 2055;

You rank Zambia among st other criteria as below etc and see the performance it has registered That is the way such poverty and comparative analysis are done :

Human Development Index .0612

Rank in the World (region) 139

Life expectancy at birth (years)

60.8

Education

Expected years of schooling (years)

12.5

Income/Composition of Resources

Gross national income (GNI) per capita (2011 PPP$)

3,464

Inequality

Inequality-adjusted HDI (IHDI)

0.373

Gender

Gender Development Index (GDI)

0.924

Poverty

Multidimensional Poverty Index (MPI)

0.264

Work, employment and vulnerability

Employment to population ratio (% ages 15 and older)

67.3

Human Security

Homicide rate (per 100,000 people)

5.8

Trade and Financial Flows

Exports and…

What has life expectancy got to do with imports at the same level with exports and therefore the nation making no money from international business?

What does Gender Development Index got to do with running deficits in the current account balances from servicing excessive debt and paying for unnecessary FDI?

You can’t do frog jumping to strengthen muscles around your neck. I thought the author is discussing…Zambia broke! the issue is Cash, money not any good social cultural constructs…As somebody here wrote…whatever trash you guys are reading to run the country stop it!

A healthy and well developed country in those Indicators is Positive towards economic performance and well being

Wherever economic analysis and comments he has made comes to the HDI A well developed coutry will create reserves by saving on costs opportunisming its factors of production to register positive economic and HDI

You do not just borrow to invest in sectors or infrastructure or create and reserve or control the economy just for cosmetic it has to reflect ultimately on people well being and quality His conclusion is therefore wrong

Officially off and Napyamo see you in 2055 Best regards;

but its always important to cross check data also We know that useful CIA report a good projection but must be validated and aligned to actual Its a good forecast though i have respect for it and those analysts There are good and resourceful Napyamo;

Like Argentine below lets be positive and upbeat about Zambians fortunes and engage IMF fairly It comes to that Its about perception and sentiment okay whether this party or who is there fair analysis will be positive for Zambia

See Argentina making progress below

Statement by IMF Managing Director Christine Lagarde at the Conclusion of the Executive Board’s Informal Meeting on Argentina

May 18, 2018

The Executive Board of the International Monetary Fund met today in Washington D.C. for an informal meeting on the Argentine authorities’ request for financial support. The meeting was an opportunity for staff to update the Board on recent economic developments in Argentina and present the government’s program in more detail. The…

Don’t compare Africans to Europeans. Europeans go to school to learn ideas not a language. Africans (Sub-sahara) go to school to learn two things, a language and ideas. From the first grade up to University level, England learn in their native tongue, Spain in their native tongue, Portugal, France, Denmark, Germany etc. But Zambia, Zimbabwe, Angola, Mozambique etc. in their colonial master’s languages. Egypt was also colonised by the British. Today, English is not the official language in Egypt.

How many Zambians have been denied to go to higher institutions of learning, just because they failed English?

Unless we change our education system, things will just remain as they are.

Imbwa eishiba fye no kumfwa icilumba mululimi lulanda shikulu waiko.

We are human beings and we have our…

Professional narrative of Zambia’s economy compared with neighboring countries!

Excellent! this is how we should analyse our country. not guess work and propaganda chabe. with such information, we can make informed decisions

@Chimbwete careful when you talk about indigenous language. The United States and Canada were colonised by England and still speak English (half of Canada). So were the Australians and New zealanders. In south America and Europe there are some countries which were ruled by the Spanish and still speak spanish Today. Careful when you talk about national language and identity. In Zambia why does North Western Province have three languages on national television? When you discuss things be practical and research widely otherwise you will miss lead yourself and expose your half bakedness.

@Chimbwete I am still on your case. Out of 72 dailects which language will you make the national language of Zambia and what criteria will you use. Do you believe everyone will agree with your choice? Please do not give me the Tanzanian case.

Comments are closed.