A Consortium of Civil Society Organisations says it remains deeply concerned about the country’s debt situation which continues to inhibit Government expenditure, and subsequently negatively affects citizens’ livelihoods.

The Consortium comprises the Consumer Unity and Trust Society, Civil Society for Poverty Reduction, Non-governmental Gender Organisations Coordinating Council, Action Aid Zambia, Oxfam, the Centre for Trade Policy and Development, the Jesuit Centre for Theological Reflection, Caritas, Transparency International Zambia Development Finance Associates and the Alliance for Community Action.

They said Zambia’s economy and its citizens are struggling, and the national debt is at the heart of the issue. As civil society, we applaud discussions about re-engagement with the International Monetary Fund.

The CSOs note that the IMF could offer valuable concessional finance which would ease the current liquidity crisis and relieve pressure on the economy.

They said they, however, note with concern a seeming lack of substantial progress in agreeing on a support package given that discussions with the IMF on a bailout package are dependent on our debt reaching a sustainable level.

The CSOs said with or without the IMF, however, tough action on debt cannot be avoided for much longer. The government needs to take urgent and deliberate action to put the economy back on track, starting with a restructuring of Zambia’s infrastructure projects, an improved public financial legislative framework and a revised and comprehensive plan to manage debt.

“We are of the view that Zambia’s debt situation remains the primary cause of Zambia’s struggling economy. While indeed the effects of climate change on the energy and the agriculture sector have negatively affected growth this year, it is not the primary cause of Zambia’s economic situation”, they added.

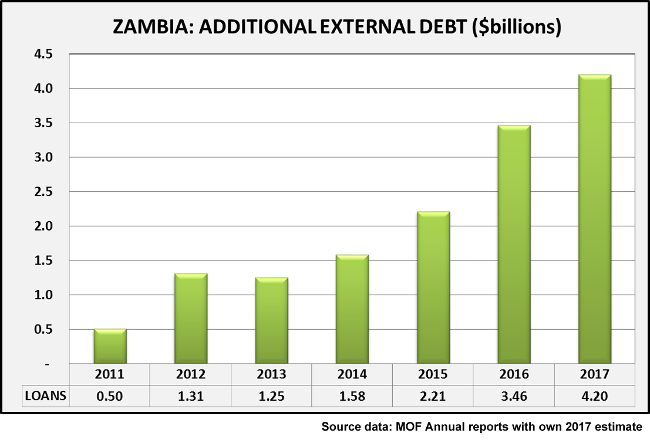

They noted that over the past ten years Zambia’s debt has increased at untenable levels and as such we find ourselves in a situation of high risk of debt distress. Currently, our debt to GDP ratio stands at 78 percent and according to the IMF, this is projected to reach 92 percent by the end of the year.

The CSO’s noted that this level of debt has weakened the kwacha, constrained growth and limited government’s ability to respond to the external shock of climate change.

They added that due to Zambia’s high debt levels, ordinary citizens are increasingly experiencing a high cost of living, driven in part by the weakening kwacha, high fees and taxes, and reduced job opportunities, combined with low investor confidence, arrears and a high tax burden on business.

Further, the CSO’s said because of the debt, government’s spending on social sectors has been adversely affected negatively impacting citizen’s access to social services such as access to quality health and education.

They noted that the reduced expenditure in the social sectors is without doubt adversely affecting the most vulnerable in our society, especially women and children. While Government has taken some steps including the release of quarterly updates by the Ministry of Finance, announcements of the proposed slowdown in contraction of infrastructure projects and the abandonment of the sales tax, the measures are currently insufficient to put the economy back on course, particularly given the recent indications of further borrowing for various infrastructure projects.

“In May this year, the President convened an extraordinary Cabinet meeting on Zambia’s economic challenges, which recognized the scale of the problem and made positive commitments to addressing debt. What it is required at this point, however, is the political will to implement the measures which will lead Zambia on the path of economic recovery, set debt on a downward path and reduce domestic arrears”, they said in a statement.

They said with the Ministry of Finance’s plan to restructure the infrastructure project portfolio to be discussed at Cabinet, we urge the government to demonstrate the necessary commitment to kickstart Zambia’s economic recovery and outline a key strategy with quantifiable milestones on how they intend to achieve this goal.

“Government needs to put in place long-term measures to generate confidence in Zambia’s economy which will have dividends in stabilizing the kwacha, reducing the price of borrowing and providing a route to refinancing the country’s long-term debt obligations. To do this, Zambia needs to firstly introduce legislation to improve debt management”, they said.

They said this includes, revising the Loans and Guarantees Act and the Public Procurement Act, as well as enacting the Planning and Budgeting Bill adding that these pieces of legislation will increase accountability, transparency and budget integrity while curbing the mismanagement of public finances and reducing wastage.

The CSO’s noted that one major concern on the part of civil society is the proposed revision within the Constitution of Zambia (Amendment) Bill No. 10 of 2019 that seeks to remove parliamentary oversight on the contraction of debt.

“Debt transparency enables borrowers and lenders to effectively evaluate the sustainability of public debt and monitor emerging risks. Recent cases of hidden debt, notably Mozambique, demonstrate the adverse social, economic, and political consequences borrowers can face. Secondly, the Government needs to develop credible long-term plans to manage debt. This process starts with a revised Mid-Term Debt Strategy which addresses how the government plans to manage upcoming debt repayments. It should be complemented by a refinancing strategy for Zambia’s Eurobonds to restore public confidence that the government has the means to manage its debt in 2022 and beyond”, they added

They said this planning should be backed up not only by restructuring infrastructure spending but by also by outlining quantifiable and measurable austerity measures to reduce the national budget percentage of the wage bill in order to protect productive and poverty-alleviating expenditure.

“In order to do this, there is the need for deliberate measures to ring-fence social sector budget allocations if the country has to achieve its plan to reduce poverty and vulnerability as outlined in Pillar 2 of the Seventh National Development Plan. Civil society call for urgent action to mitigate the impact of debt on the economy and citizens”, they added.

“Ultimately, the IMF is well placed to support the Government to relieve this pressure, but we welcome any move to address debt and put the economy back on track. This week’s decision to approve and publish plans to restructure infrastructure projects would be a vital first step in demonstrating commitment – and delivering for citizens”, they added.

Right on, CSOs. No debate about this one.

Zambians deserve what they are going through! Our people are easily cheated! Hope they have learnt that being “humble “ is the wrong qualification for public office! Competence is what counts! They chose to vote for tribe (wako ni wako) and a song whose meaning was very clear. Now that you have the reverse you wanted, live with it and more misery to come! In life, you reap what you sow! Can the same people who put our country in this mess get us out!

The usual suspects. The same NGOs that have tried to control the hegemony of our nation. They have regrouped to drive the regime change agenda that has branded PF as a threat to western interests. They support the liberal minded tribalists of upnd whose support is regional but imperialist friendly. These NGOs hate Edgar Lungu because he doesn’t bow to them. Levy always danced to their tune. Usual cr@p here…

Zambian Citizen: Of course u know the truth about Levy and it’s that he danced to nobody’s tune. He turned down GMO maize from the West and u still accuse him of wht cannot possibly stick. U’re free to hate him as much as u like. But u also know about how peaceful the 2006 general election which he presided over as head of state was.

Yes Zambia’s debt situation is alarming and with the country’s GDP growing at just 2% p.a the debt will get worse.Drastic changes are needed.

The PF impoverishing Zambians since 2011 with high debts,high inflation and economic stagnation.

Comments are closed.