Fr. Charlie Chilufya, S.J.

Economic and financial turbulences worsened by the COVID-19 crisis are fast appearing for Zambia as prices soar and as the Kwacha goes into a fast-downward spiral and free fall. If not resolved by both Zambia and the international community they are projected to characterise Zambia and other low- and middle-income countries especially commodity-dependent economies. These turbulences will frustrate its growth prospects in the years 2020-24 projected by Zambia’s Finance Minister Dr. Bwalya Ng’andu in his budget speech. A potential consequence of the pandemic that is now being recognised is in fact potentially more important: increased financial fragility, implying the potential for a debt crisis and even a broader financial collapse. With measures being taken by the government, COVID-19 will be contained and we are sure policies are being implemented to ease the situation. Supply chains may be restored and people will return to work with the hopes of recovering at least some of their lost incomes. But in countries like Zambia real economic recovery could be derailed by unresolved financial and debt crises. Therefore, care must be taken to forestall this possibility.

Not a New Problem

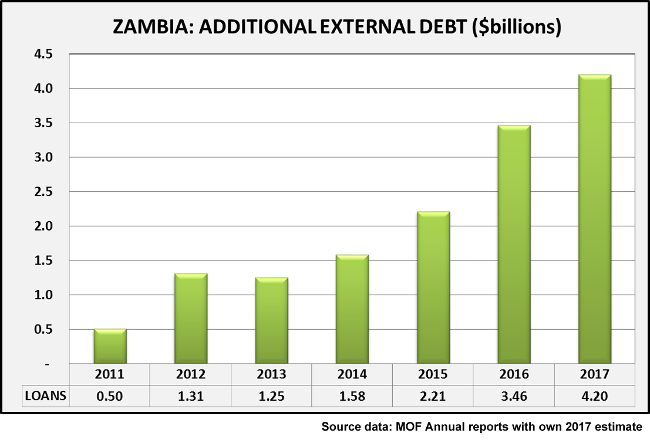

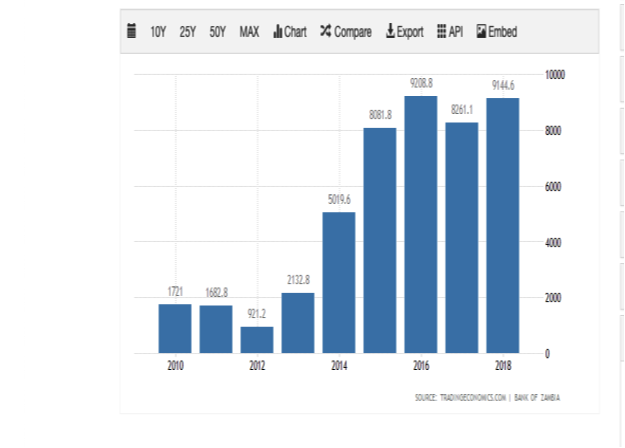

Zambia’s current financial fragility far predates the COVID-19 crisis and is not the first one. Since 2013 Zambia has massively accumulated debt mainly meant to finance critical infrastructure development. External Debt in Zambia increased from 921.20 USD Million in 2016 to over 9,000. USD Million in 2017.

We can surmise that it has long been clear that even a minor event could have had far-reaching destabilizing effects. In the last five years, in an attempt to keep the Kwacha stable, the Bank of Zambia has been using loose monetary policies that have only disguised the fragility of the Kwacha and mounting debt levels. As COVID-19 shock is now showing us, nothing can be hidden forever. 2019 already warned of impending problems: an over-arching US$20 billion debt burden, pitted differences with the mining sector over tax policy inconsistencies, among others, Zambia was already facing dwindling export capacity resulting in lower than envisaged foreign exchange reserves.

In its 2019 report on Zambia, the Economist Intelligence Unit (EIU), a wing of a British business within the Economist Group providing forecasting and advisory services through research and analysis, saw a torrid macroeconomic environment for Zambia for the period under review. The EIU already foresaw an over-leveraged government struggling to meet its debt obligations. The EIU bemoaned government’s interference with critical sectors like mining over unabated tax differences, in turn, driving away foreign investment and hurting output. For sure that kept exports well below potential levels and ultimately affected Zambia’s reserves position, which by the end of 2019 had fallen to an all-time low US$1.4 billion.

In its recent March 2020 analysis, the United Nations Conference on Trade and Development shows how in the wake of COVID-19 sustained debts could pose a larger problem for the both the advanced and emerging economies. Currently, Zambia’s total debt (private, public, domestic, and external) has risen to equal 70 percent of its GDP – the highest it has ever been. Particularly concerning is the outstanding US$3 billion Euro bond loan, with the first bullet payment of US$750 million due in 2022. How is Zambia going to finance the repayment of these arrears with drastically dwindled demand for its main export to China, copper, whose price tumbled this week to less than $ 5,000 per tonne, the lowest since 2016. An IMF facility could be Zambia’s saviour but the IMF has not been very pleased with Zambia’s approach to borrowing. Without an IMF programme, it’s uncertain how Zambia will repay US$3 billion in outstanding Eurobond debt by the close of the due period 2027. In the coming few years Zambia will be less robust in the face of further outflows and of need to keep the local currency stable currently on a free-falling trail in the face of diminished China demand for the red metal, Zambia’s primary source of foreign exchange.

The COIVID-19 Shock

Even in the best of times, these financial conditions could be worrisome. But now we are in the midst of a severe shock, the COVID-19. Zambia is deeply integrated financially and economically with China and thus highly vulnerable. As noted already, Zambia has experienced dramatic decreases in copper exports to China, disruptions to the sourcing of raw materials and intermediate goods, infrastructure projects, and basic supplies of finished goods and services. These disruptions are already having severe negative business and employment effects across the Zambian economy. They are affecting individual households and may mean no food and other basic supplies for families. And now the financial concerns over the Zambia’s already high debt levels are exacerbating these adverse outcomes.

What Should Zambia do?

The first question really should be “what should Zambia not do?” Since Zambia’s debt started to rise, there have been fears that despite the surmounting problems, Zambia remains bent to further borrowing over the medium-term for a series of debt-financed infrastructure projects. But in the wake of the economic impacts of COVID-19 Zambia may face even more serious balance of payments (BoP) problems. In that case Zambia will need the IMF. If Zambia follows the path of more borrowing, it may prevent lenders, including the IMF’s envisaged bailout failing to materialise. As the EIU warned last year, without the IMF package, Zambia will be at risk of failure to clear the outstanding US$3 billion Euro bond loan, with the first payment of US$750 million due in 2022.

As it did in its bid to qualify for the HIPC debt relief initiative, Zambia must commit to policy changes, and demonstrate “sound economic behaviour.”

- Zambia should seek multilateral support of interest-free loans and grants at subsidised rates; The World Bank has approved a $14 billion package of fast-track financing to assist companies and countries through grants and low-interest loans from IDA for low income countries and loans from IBRD for middle-income countries

- Zambia should stick to its borrowing plans, as outlined in the medium-term expenditure framework.

- Zambia should reembark on reform and sound policies, if need be through the IMF- and World Bank–supported programs

Zambia Needs the Support of the International Community

The current crisis, both from the health and economic perspectives, has shown us that the world is now interconnected in ways that we never imagined before. These problems that Zambia is facing cannot be contained by policies adopted in any one country. Zambia is not alone in its current financial and economic quagmire. Commodity dependent economies like Angola, Nigeria, Congo DR, Ghana and others are already facing similar difficulties. Even industrialised South Africa is in similar difficulties on account of its tight economic bonds with China.

More than ever, the global community needs cooperation guided by good global leadership to address the immediate effects of the coronavirus pandemic and its economic fallout. Countries, starting with SADC urgently need to collectively tackle the debt crisis that will soon unfold. The deepening and acceleration of globalization that we have seen during the last five decades of increasing interconnected have opened up the world to massive cross-border flows of goods, services, money, ideas, data and people.

As others have suggested, it is time to start thinking about coordinated debt resolution and restructuring. Countries need forward-thinking that will establish coordinated debt-resolution strategies that are essential in today’s interconnected world. Our interconnectedness in the current globalized world means we are fragile together as the COVID-19 crisis has shown us. If we are collectively to survive not just the normal depredations of global markets, but also the existential threats posed by pandemics and climate change, there is no alternative.

Enhanced International Cooperation

This is a time for enhanced international cooperation. Countries should not wait before the worst happens. They can start by taking a cue from the HIPC Initiative. The HIPC Initiative was launched in 1996 by the IMF and World Bank on behalf of all member countries, with the aim of ensuring that no poor country faces a debt burden it could not manage. Since then, the international financial community, including multilateral organizations and governments, have worked together to lower to sustainable levels the external debt burdens of the most heavily indebted poor countries. Through the coordination of the IMF and the World Bank, the Initiative allowed the external creditors to provide faster, deeper, and broader debt relief and strengthened the links between debt relief, poverty reduction, and social policies.

Countries can also learn from how the London debt agreement of 1953 between Germany and 20 external helped Germany, at the time a major debtor. Through the agreement external creditors wrote off 46% of the country’s pre-war debt and 52% of its post-war debt, while the remaining debt was converted into long-term low-interest loans with a five-year grace period before repayment. Most significantly, Germany had to repay its debt only if it ran a trade surplus, and all repayments were limited to 3% of annual export earnings. This encouraged Germany’s creditors to be vested in its export success, creating the conditions for the subsequent boom. Zambia and other countries in similar difficulties need this kind of help.

Get well soon Mr President

This should be the death of neoliberal ideology in Zambia and around the world. Almost a decade ago, this massive blow up of debt was completely predictable and predicted – and of course dismissed as any information that could stand between the neoliberal politicians and a bribe is dismissed.

(STICKY) Chikwanda describes advocates of windfall tax as lunatics

*****

There has to be a return to demand side economics, instead of the supply side economics of the last 1/3 of a century. Economies need demand, not just supply. See FDR. See Huey Long. See UNIP and ZANU-PF before neoliberalism.

There is no country in the world which does not borrow. PF stands for instrastructure development and being ready for the rainy day as any good oarent would do is not in PF vocabulary.

We will sort it out just give us another fice years.

“COVID-19 is a ploy by the opposition to make government unpopular so that they take over power”, that is what Sunday Chanda and Antonio Mwanza would say.

Insightful and wholesome write up. Blessed is the critic who offers solutions.

Economy in Zambia is not hit by covid 19 no no understand well about this. In Zambia recorded only 3 people while in SA 402. Ever covid 19 or not Zambia economy is bad coz of our leaders.was our economy good last month for us to say we are affected by covid 19? look at the debt Zambia we are in now did they borrow to fight covid 19? 25 people went to Malawi to receive 2 old fire trucks km899999(model 1980) how much they cost to buy food and guest houses.42 tender trucks k1000 each you pocket yourselves crooks idiots.

Thanks for the article and offering solutions. We will review these and let our specialists advise on way forward.

Our British brothers and sisters, you are in our thoughts and prayers. The president will soon issue a communique to his counterpart in the United kingdom to render his support during these difficult times. Please also note that the British high commission in London remains closed until further notice. Kz

KZ

hehehehe ……..

Lungu is in hiding , what support can he render to the UK if he can’t even pay his own people salaries ???

Lungu and PF must be soooooo greatfull for corona , they can now blame everything on corona……

QUOTE: Economic and financial turbulences worsened by the COVID-19 crisis are fast appearing for Zambia as prices soar and as the Kwacha goes into a fast-downward spiral and free fall.

IS THIS TRUE BANE? I THOUGHT OUR KWACHA BECAME A quinceañera WAY BEFORE THE CORONA VIRUS HIT THE SHORES?

KZ get your facts right, to say the Lungu is sending his regards to his counter part, well the UK does not have a president, the head of state is Queen Elisibeth 2 and to say the British High commission in London is closed is wrong there is no British High Commission in London, you only have British High Commissions in Common Wealth countries outside your home country.

President Lungu needs to call Mangande and Musokotwane. They steered the ship to growth during the 2008-2009 economic doldrums. This is for Zambia and not politics.

Hahaha. KZ. Thoughts and prayers seems to be the only thing Zambia can give to Britain. Apart from that there is simply nothing else.

Excellent analysis of facts and proposal of solutions. This is a great example of objective and mature criticism that opposition political parties or patriotic Zambians should engage in. Suffice to say that; There are great evident successes that the government of Zambia has scored. There are also areas that needs improvement. Government of Zambia must be commended especially on the aspect of creating a conducive business environment by way of massive public infrastructure development and making it easier for any investor either local of foreign to start a business by streamlining the business registration process. If many people in Zambia can engage in strategic value added exporting businesses, the strength of the Kwacha against major currencies in the world won’t be a problem.

Come 2021, economic situation might be much more dire. Zambia shall postpone 2921 elections and use the money for affected community

This is life and death and no politicking people.This is a global issue and we do not need to blame one another but only a f**l can do that.Its time to adhere to what the medical personel are telling us kwasila.

Comments are closed.