NAPSA has denied media reports that it has agreed to buy 100 percent shares in Lumwana Copper Mine for a total consideration of US $895 million in cash.

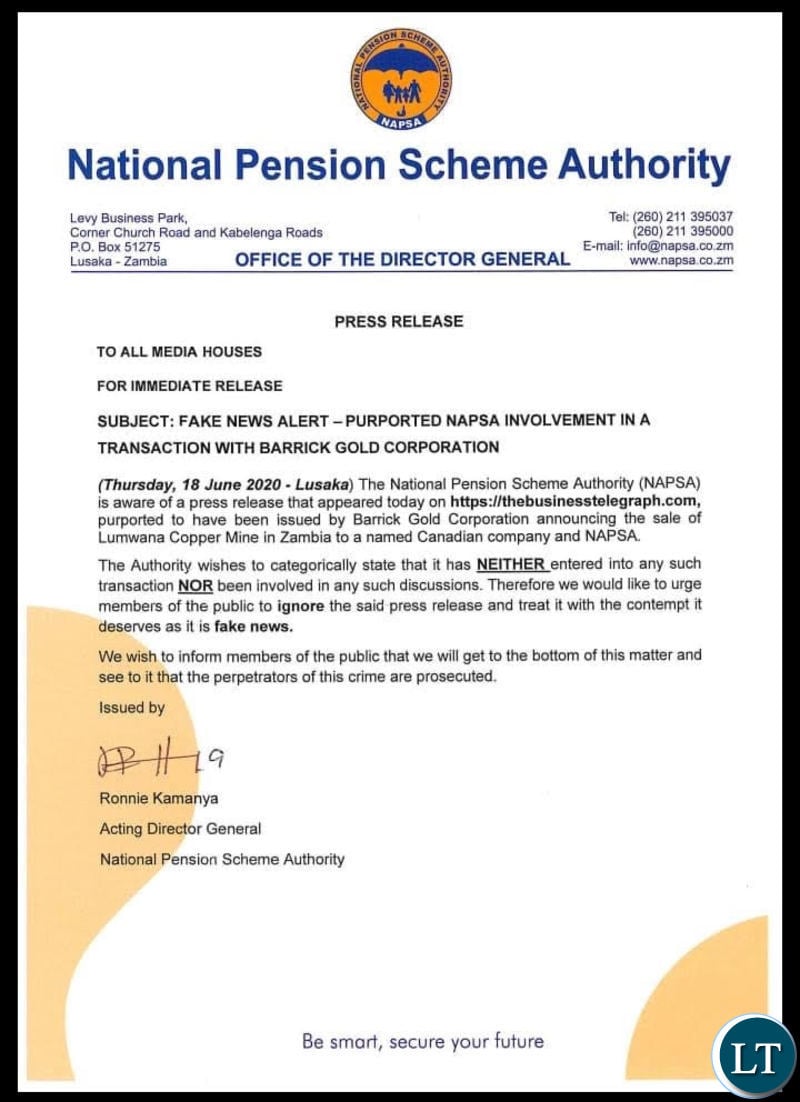

In a statement NAPSA Acting Director General Ronnie Kamanga said NAPSA has not entered into any such transaction nor been involved in any such discussions.

“We would like to urge members of the public to ignore the said press release and treat it with the contempt it deserves,” the acting director general wrote, adding that the pension fund would seek to ensure the perpetrators were prosecuted.

The news story claimed that Barrick Gold Corporation has agreed to sell its 100 percent interest in Lumwana to Metalinvest Capital Corporation (Metalinvest) and NAPSA for a total consideration of US $895 million in cash.

The press release dated June 15 quoted Barrick president and chief executive officer, Mark Bristow saying the sale of its interest in Barrick Lumwana Copper Mine represents the third step in their plan to realize in excess of US $1.5 billion from the disposal of non-core assets by the end of this year.

He is said to have said that while this iconic Copper mine has been a valuable contributor to Barrick over the years, the asset does not fit with their strategy of operating mines that they owned.

“The sale of our interest in Barrick Lumwana Copper Mine represents the third step in our plan to realize in excess of US $1.5 billion from the disposal of non-core assets by the end of this year.

“While this iconic copper mine has been a valuable contributor to Barrick over the years, the asset does not fit with our strategy of operating mines that we own. The sale allows us to further focus our portfolio on core operations,” Mr. Bristow said.

The story further claimed that Mr Bristow expressed pleasure to have achieved a successful outcome following a competitive sale process and that he was confident that Metalinvest and NAPSA would be an excellent partners at Lumwana Mine going forward.

Metalinvest Capital Corporation is a federal corporation registered in the province of British Columbia, Canada and operates as a private equity firm focusing in mining sector.

Metalinvest founded and led by Mohamed Matongo since 2010, is a private equity firm that has successfully financed and concluded multi- billion dollar mergers and acquisition transactions mostly in Africa.

Credit Suisse Securities (Canada), Inc. is said to have been acting as financial adviser to Barrick. Davies Ward Phillips & Vineberg LLP and Herbert Smith Freehills LLP are acting as legal counsel to Barrick.

And Barrick Gold says it has alerted authorities after what it says was a fake news release claiming it has sold Lumwana mine.

Metalinvest also said it has no knowledge of the deal and is launching its own investigation, founder and director Mohamed Matongo said in an email to Reuters.

“It has come as a great surprise to me that my company name is being mentioned in a transaction that we have no knowledge about,” he said.

Barrick was last year seeking buyers for its Lumwana copper mine, but in February Chief Executive Mark Bristow told Reuters he would not necessarily sell it, and might instead look for a partner in Zambia or a deal with a copper processor.

Barrick Gold said yesterday that there is “absolutely no truth” in a news release circulated on social media in Zambia claiming the gold miner sold its Lumwana copper mine.

“We don’t know who’s behind this and we have alerted the relevant securities regulators and law enforcement authorities,” a Barrick spokeswoman told Reuters in a statement.

If that were to happen then it was gonna be the greatest news for Zambian companies.

Maybe its not NAPSA but NAPSA Limited.

Too risky investment for a Pensioner!!! Copper production prices rises and falls unexpectedly. That’s people’s premiums and they will need it.

@Yaks, it can’t be worse than the Kalulushi Housing Project, not even ECL Mall in Kitwe. And come to think of it, a massing structure of that sort is named after ECL2021 and the King Cobra gets the honour of a mere over priced Toll Plaza named after him. This world is amazing!

A lot of fake news. This is why my fight continues to try and introduce a bill for stringent laws against fake news spreaders and also more powers for us to ban such platforms and to tax online news websites

I’m afraid I cannot believe the NAPSA denial. I will wait and see wht happens nxt. They even want to waste money by taking legal action which can only be in Canada. A simple denial would hv sufficed but threatening legal action makes me suspicious. It can only come from an organisation that has more money than common sense.

It beats me how a pension scheme could even be a better manager for the mines. Did whoever is behind the alleged “fake news” run out of ideas of companies to implicate?

A cash consideration of US $895 million would be a huge loss as Barrick acquired Lumwana for close to $8 billion.

For the average Zambian who typically has a short memory…..

Reuters – April 25, 2011

“China’s Minmetals Resources bowed out of the battle for copper miner Equinox Minerals on Tuesday, saying Barrick Gold Corp’s $7.7 billion bid was too rich to justify a counter-offer. ”

BLOOMBERG – Apr 25, 2011

“Barrick Gold Corp., the world’s biggest gold company, agreed to buy copper producer Equinox Minerals Ltd. for C$7.32 billion ($7.66 billion)”

Comments are closed.