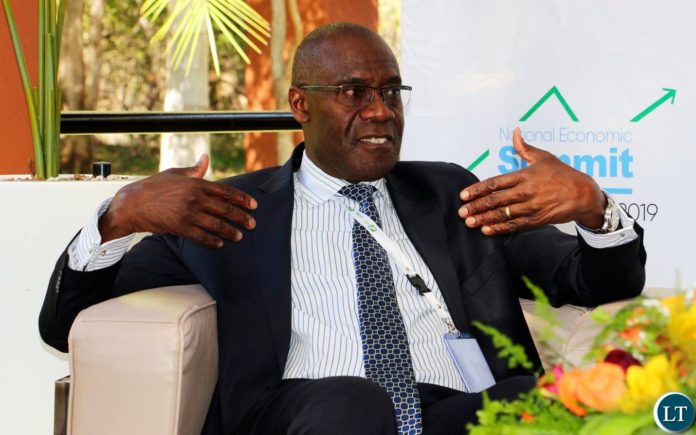

Finance Minister Bwalya Ng’andu has revealed that Zambia’s total indebtedness now stands at $18.5billion.

This is inclusive of continent liabilities and debt owed by State Owned Entities with an average interest of 4.5%.

Speaking during the investor call following Zambia’s request to defer coupon payments on its dollar bonds for 6 months, Dr Ng’andu told bondholders that Zambia’s debt position to gross domestic product was 104%, breaching the IMF and World Bank threshold of 35%.

“Zambia is spending half of government revenue collections to service interest on debt currently compared to a few years ago when only 20% of revenues would be channeled towards interest obligations,” Dr. Nga’ndu said.

“It is become increasingly difficult to service debt. Of the $18.5bn, external debt owed by government directly is $11.97bn while the remainder reflects obligations by SOEs and is also in contingent liabilities, he said.

Dr Nga’ndu advised investors that the pandemic period has necessitated the ask to defer interest payment so as to create fiscal space as this will allow survival in crisis time while hedging the country against interest penalties for delayed payments.

“Debt stand still is required for us to work with the IMF. We are working within the Debt Service Suspension Initiative – DSSI rules to qualify for the upper credit crunch program by the lender,” Dr. Ng’andu said.

“As is we are in breach of the IMF benchmarks. We are strongly committed towards implementing reforms that will address fragility. We will aggressively pursue systematic creditor and debt management strategy.”

And who is going to pay for that…The PF has messed up everything. Lungu should have not bought the planes with borrowed money.

Fire trucks, 48 houses etc….

God help us. Nevers told the Nation that his computations showed a huge debt portfolio for Zambia. But the government has beeen debunking that. usd 18 billion is too much money. When citizens with foresight called for a stop to increasing threshhold % borrowing space, ALEXENDER Chikwanda called called Zambians LUNATICS. Never apologised. Mutati called Zambians ignorant. He appologised. Zambians are vindicated. Debt is now haunting us.

God help us. Nevers Mumba told the Nation that his computations showed a huge debt portfolio for Zambia. But the government has been debunking that. Usd 19 billion is too much money. When citizens with foresight called for a stop to increasing threshhold % borrowing space, ALEXENDER Chikwanda called called Zambians LUNATICS. Never apologized. Surprisingly , ABC is still PF financial advisor. Mutati called Zambians ignorant over debt borrowing. He apologized. Zambians are vindicated. Debt is now haunting us.

I thought we were told that we don’t need the IMF as a sovereign nation by the current? Why are we now trying to convince foreign bond holders that we are trying to work with the IMF? Zambia is spending half of government revenue collections to service interest on debt? How did we get to this point?

Last time UPND said $7billion, 2 years ago, and all world was in shock. But today the only PF minister with right mind says $18 billion? $18 billions in debts? Even cabinet ministers, especially those MMD Doras will pass out. They never heard of such figures in loans.

Bwalya will also be fired for being truthful like his ex-boss Kalyalya.

Alexender Chikwanda called Zambians LUNATICS when Zambians opposed the increase of borrowing threshold %. He never apologised . To date he is the PF financial advisor advisor. Mutati called Zambians ignorant on matters of debt. He apologised. USD 19 million is unsustainable. Nevers Mumba has repeatedly told Zambians that Zambia’s debt is more than USD 13 MILLION.

I was mostly right saying Zambia owed $17 billion , I have said this ever since the rats denied we owed that much ……..

Zambians will never be able to pay off this debt , not even in 50 years.

Zambians have a capacity to maintain and payback roughly $3 billion looking at our work ethic , population, mineral wealth. $ 18 billion is beyond us.

When we were telling them , they were busy sontaring

Look now ?????

Margaret Mwanakatwe said Zambia was facing no debt crisis, adfing that she could pay with Mukula wood.

Margaret Mwanakatwe said Zambia was facing no debt crisis, adding that she could pay with Mukula wood.

To quote the Mast newspaper’s editorial comment yesterday: “Dr Bwalya Ng’andu is a ‘malukula’ and the 2021 budget is a mortuary because we will need to borrow in order to finance next year’s budget”. This country is becoming more and more useless by the day. We are actually on the verge of reaching the status of a failed nation

I have always said zambia is in $17 billion debt , not far off the mark.

Zambia is begging for debt breathing space , meanwhile the PF rats are telling us all countries , even the UK and USA borrow ……..

We tell them just because an elephant can cross a deep river , does not mean all animals can also cross …….they don’t know what we mean by this ?

You find out the meaning of this phrase soon……

Congratulations Dr Ng’andu. For the first time since Dr Musokotwane we have a minister of finance who has told the truth. Chimwanga with his communist economics, Mutati with ‘Lungu anikonde’ and Mwanakatwe whose alcohol blood levels are very low, lied and lied. Unfortunately, the majority of Zambians like Mwanza at PMRC do not understand the implications and for the last 9 years they have praised every budget, INCLUDING this one. So, they will return Lungu to power because if he gets IMF relief, he will use it to bribe the voters with head bands and a bag of Millie meal.

Where those PF dwarfs who are hell bent always praising Edgar Lungu!?

In fact Dr. Ng’andu is very economical with the truth Zambia’s debt maybe standing at $25 billion if we were to scrutinize the Zambia’s statement of financial position (balance sheet)..

We need to commission of inquiry to understand how these debts were used.

After that arrest those who have brought us into this messy situation.

Alexander Chikwanda and other former finance minister together with other controlling officers must be investigated.

This is where we must spend our energy.

The funds were squandered by these PF corrupt leaders.

PF must go!

What is wrong if the money ws used for infrastructure development? Viva Lungu, Viva PF

While the figure of the debt portfolio is correct, the debt to gross GDP ratio (104%) is wrong. Zambia’s GDP (PPP) is $76billion while GDP (nominal) is $24billion – so how does debt to GDP ratio reach 104%? However, the debt is too high and our current revenue cannot sustain it.

And now the world can now see the pregnancy of the woman like we have been saying

The National Planning Commission will summon Dr Ng’andu for this. It is the new trend. While that is happening, the Police will issue a callout for him to explain that figure. Incompetence always calls for intimidation. I hope he cleared with the cadres, too. Pa Zed the game is distraction. Meantime ci Dora is quiet like a scared mouse.

sela twibeko iwe!!!!!!!!!!!!!!

The article clearly states and quotes the minister alluding to the pandemic as a reason for requesting payment freeze. Go and read how much debt the UK and America has accrued during this period. Some of you diasporans live in those countries and yet have no bl00dy clue what is going on there. You are quick to criticise Zambia and African economies because you cannot or are scared to critic the whlte man who is keeping you there abroad

Just shut up you bootlicker without shame. You’re busy writing nosense if things are ok when you know things are not well.

You must grow up young man. You stayed too much in poverty and now you think you have made in life with finite materials.

PF must go!

I have never seen a dull Chap like Mr. Kaizar Zulu. Most of your comments lacks substance and indicate that you are not patriotic to the nation of Zambia. Critics with substance can build a nation. Praises without substance destroys a nation. For example, we give credit to PF government for building 750 MW Kafue lower at a cost of about US$ 2.5 billion. If the government was serious of paying back this loan, the Kafue lower Hydro itself can pay back this loan between 4 to 5 years. Such an investment we say thanks to president Lungu. But for Zambia Airways investment is a trash- It will not yield any profits in the next 8 years, but will need to be given money for the next 8 years for operations. So you want us to be praising PF for less money in the pockets of people and bad projects…

kaiza zulu what do you say

u idiots have reversed all the gains that we have made as a country

$18 billion in debt and raising …….longterm permanent fulltime unemployment a given..

Then we have a shamless rat claiming he wins elections ????

Wins elections for this ??

Kakaiza zezulu you have no shame because you have been drunk with looted funds and borrowed power. The debts accrued by the two nations you mentioned since covid19 has been to pay employees on furlough, if it ever means anything to you. Whereas you, Meomeno and your likes have amassed your personal wealth during the same period.

Well done Dr Edgar Chagwa Lungu!

Please continue the good work!

Zambians are blessed to have you as their pilot. It’s good you are not flying without a parachute. If hell breaks loose, at least you have a great Mansion in Eswatini!

Umunani wa fipuba bupwila muli Tumfweko!

The true figure is likely to be higher.

Much higher!

Consequences of defaulting will be catastrophic.

This finance minister is a good man. He is honest. He is what Zambia needs.

But he will be fired by Mwankole.

According to the “International Debt Statistics 2020” report published by the Worldbank (see page 144), Zambias’ total debt in 2018 stood at $19 billion. So Dr Bwalya Ngandu is actually understating the debt figure as the PF have borrowed over $2billion since 2018.

The total debt must be around $22 billion.

Seriously , the PF have destroyed Zambia.

Zambias GDP (PPP) is $76 billion and GDP (nominal) is $26 billion – So, at a debt of $18 billion, where does the 104% debt to GDP ratio cone from. The debt is obviously very high due to reckless borrowing marshalled by reckless and incompetent civil servants (when that debt was bbeing acrued where were the BoZ and Ministry of Finance??). Bloggers also, instead of just jumping to political bias, do a bit of check even with your dullness.

Atleast UNIP ACCRUED $4 Billion,

MMD Atleast left Reserves of about $3 Billion dollars

PF how much Reserves will they leave after leaving office?

I don’t know why we panic …Do you know that the debt can be easily paid… Just wait through the mining sector. We have a lot of minerals …Plus the marijuana growing business.. What is 20 billion dollars! Zambians relax. There is a lot we can do.

20 billion US$ is not much, but the government doesn’t know how to create wealth despite having numerous natural resources. How much money have they made since PF came to power? COVID-19 affects all countries, therefore it is not an excuse.

We shall dig our copper, gold, zinc, diamonds and pay them off what is 20 billion dollars!

The fact that we have been mining copper and other minerals for 50 years now, and 60% live in poverty, means that it is not possible to pay back that 20 billion in a short time. Why not mine minerals and sell them to have money for projects. Give it a thought.

The human body is a complete self-regulating machine with systems including visual and auditory all controlled by the brain and peripheral accessory systems. The tragedy is that those leading us appear unwilling to use their auditory systems to listen and act responsibly; they refuse to use their visual systems to see that the country is headed for a sh1t drain and more tragically, they refuse to use their brains to coordinate their dysfunctional systems. The end result: national debt = $23 billion, balance of payment negative 32%; debt to GDP ration 112% and outlook, bleak and dreary. You may dance dununa, but that was child’s play. The real bomb is here and the sh1t is hitting the fan in the wake of a total economic meltdown. We warned YOU!

Iwe Saint what does it mean when alcohol blood levels are very low,. Doesn’t it mean one is as sober as a judge?

This is the govt that still want to continue in power really, what morals do these chaps have? Zambians brace yourselves for extremely hard times. These chaps will impose taxes on anything you touch so they can have a little revenue to pay the interest for the acquired loans. The minister is speaking exactly the same as the former governor who played no role in getting those loans. Edgar Lungu told you he has no plans imwe ati he is humble, this is what humbleness does to unsuspecting people. People were exclaiming that stop borrowing because you have no plans and capacity to pay back, the response was always you are jealousy. What do we even have to show for all this debt we have acquired as a nation?

We’re screeed.

If broke, then why waste money on the Police like war is about to break out.

@Kaizer Zulu, even if the USA or any of the other western countries you mentioned have trillions in debt look at the quality of life of their citizens compared to Zambians. We know who you are and where you live. Who the hell do you think you are! Were is Penza today? One day you will come face to face with one of US standing over you in your bedroom. That’s the day you will call US bwana. Behave yourself.

About the Debt:

We know that most of this debt has been acquired in the past 10 yrs. Records must be there at Ministry of Finance and all beneficiaries to these loans. Get an independent Audit firm to go through the records. Trace the unaccounted for funds. We know who got extra (corruptly or otherwise.) If local prosecute them and let them pay back, if international get their governments help. Since most of the money was borrowed from China, their people who are involved must pay back that money. Alternatively they pay back their govnmt to reduce on debt.

@Kaizar Zulu, i see that you reside in the UK and for you to even nickname yourself as Kaizar Zulu the useless presidential advisor our country (Zambia) has ever produced shows your level of education. Borrowing to sustain the economy because of COVID-19, can you compare Zambia to UK and USA . These country are far much better than Zambia even when they owe China Billions of dollars they can even afford to give a stimulus package to every citizen in the amount of $1200 (I received that money too) and as a student i received extra $1435 from my university as a student can Zambia give that stimulus package to every citizen. The answer is NO. So wake up and stop being just a Cadre with no knowledge.

When HH was engaged as a consultant of privatization he should have advised the then government to sale only 50 % share imagine we can’t manufacture toothpicks and people want the economy to perform wonders…In 1984 when the manufacturing industries where at it’s pick…This HH and the government sold companies like sweeties..

Adviser, you’re an ignorant fool. Debt-to-GDP ratio is the ratio between a country’s government debt and its gross domestic product (GDP) (measured in units of currency per year). A low debt-to-GDP ratio indicates an economy that produces & sells goods & services sufficient to pay back debts without incurring further debt, which Zambia is not. Variables including interest rates, war, recessions, & other variables – influence the borrowing practices of a nation & the choice to incur further debt. Zambia has zero capacity! It should not be confused with a deficit-to-GDP ratio, chi sleeping mwankole iwe!

The USA debt is over $26 trillion. IMF and Americans are not even talking about the debt crisis. South Africa Electricity Eskom company has $30b in debt. The problem we have is that we too focused on debt instead of focusing on national productivity. Our GDP is way too small hence this skewed debt/GDP ratio. We have potential and resources to double our GPD and ‘meet’ IMF condition. But like said before, we dont need IMF to improve our economy

Considering the rate at which the kwacha is depreciating the debt is way higher than what is being announced. Brace for tough times people. Already those whom the country was seeking an extension on the debt payments have rejected our request. We shot ourselves in the leg.

KZ those countries you are mentioning are smart enough not to contract debt past their GDP and their economies are way superior and better than ours.

@ Advisor

That is because they are giving the wrong figures than what was actually calculated from. The debt is higher than 24 billion dollars I presume.

Suffice to say the budget Bwalya presented a week ago totaled US$20 million! Now, our government confirmed debt, conservative, is US$18.5 billion dollars. It’s quite clear the real debt is near to US$25 billion! I suspect thus the 104% debt GDP ratio Bwalya was talking about is actually the Debt/National Budget ration!

Suffice to say the budget Bwalya presented a week ago totaled US$20 million! Now, our government confirmed debt, conservative, is US$18.5 billion dollars. It’s quite clear the real debt is near to US$25 billion! I suspect thus the 104% debt GDP ratio Bwalya was talking about is actually the Debt/National Budget ration!!!

You can’t compare America and UK with Zambia ati the owe debt those are powerful nations with powerful currencies the can say that to IMF and it wont say anything, this is not thinking now, if the borrowed money wasn’t misused we should have been paying back and this is good Elections plus Debt let’s see how you finance your campaigns.

Njangwamuloty – I don’t know what mathematics you are using: the budget was not $20 million, and the ratio being talked about is the Debt/GDP ratio.

Kaizer bauze bavensense leli

Bauze Kaizer banvesese lelo!

The bond holders have rejected GRZ feeble attempt at requesting to defer interest payments. They insist this government is not serious at all. No transparency. Doesn’t seem to know what they are doing. There is need to work with trusted frameworks like of IMF instead of chipantepante. See now! Us we insulted IMF. Where are we going to go now?

@Adviser .. Zambia’s GDP is $23billion not $76Billion. Get your facts right

Comments are closed.