Here’s Zambia’s secret to controlling inflation and strengthening its currency

When he first came into office, almost a year ago, Zambia’s new president was ridiculed by skeptics who called him, “the calculator boy,” for his strong focus on the economy and his background as an accountant.

Looking back now, it’s evident that these were the exact skills that Zambia needed to pull it back from the economic mess it was in at the time, having become the first African country to default on repayments during the pandemic. Since he became president in August last year, Hakainde Hichilema has steered the economy towards stability.

The Zambian kwacha is the world’s best performing currency in the world against the US dollar, rallying over 18.5% against the dollar from Jan. 22 to Sept. 1.

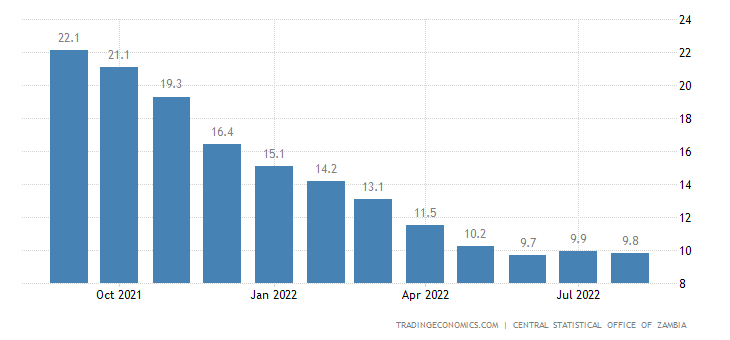

While continental peers South Africa, Zimbabwe, Nigeria, Ghana, and Kenya have been unable to control rising inflation and plunging currencies, Hichilema’s government has managed to reduce the inflation rate from 24.4% in August 2021 to 9.7% in June this year.

Zambia’s economy

What could be Zambia’s secret in shining in economic areas where almost all countries in the world are struggling? A raft of both monetary and fiscal measures, according to the Policy Monitoring and Research Centre in Lusaka, the capital.

When the government’s monetary policy committee met last November, it decided to “raise the monetary policy rate by 50 basis points to 9%.” The rate remains unchanged till now. The ultimate goal is to reduce inflation to between 6% and 8% by mid 2023 and a decline in inflation had been achieved when it met again in May 2022.

To support agriculture and livestock, the government also removed 5% customs duty on the importation of cattle and chicken breeding. The rate of rise of food prices fell from 12% in July to 11.3% in August.

Challenges still prevail though in the mining sector, which contributes 10% to the country’s GDP.

Restructuring Zambia’s debt

An agreement with the International Monetary Fund (IMF) to restructure Zambia’s debt, a $1.4 billion bailout package has seen the Kwacha strengthen against the US dollar and helped contain the rate at which prices were rising due to supply-chain disruptions emanating from the war in Ukraine and ravages caused by the covid-19 pandemic. The IMF board approved a $1.3 billion 38-month loan to Zambia on Aug. 31 in addition to another $1.3 billion special drawing rights allocation from the fund it received in August 2021.

Zambia’s inflation rate

Economist Patrick Chileshe said the other reason why the Kwacha has been gaining against the US dollar is increased forex supply. To guard against the volatility in the exchange rate, the central bank was offloading an average of $13 million per day in June.

“We have seen the Kwacha gain strength, and that was driven by increased foreign exchange supply to the market by the Bank of Zambia which was consistent in the market, whereas the demand for US dollars has been low and that led to the appreciation of the Zambian Kwacha,” Chileshe explained.

Source:Quartz Africa

Good; but prices at home are still too high!

Its not something to sing about. Here is a story from 2017 when as far as UPND were concerned the economy was in sh!t:

By Chikumbi Katebe

THE ZAMBIAN Kwacha has been described as the best performing currency and assets in Best Spot Returns in Africa, and among the six best performing in the world in 2016.

This is contained in a study published by Bloomberg, a global research and information company which placed Zambia sixth with Russia, Brazil, Palladium, Iceland and Silver as 1st, 2nd, 3rd, 4th and 5th respectively.

And Bloomberg has placed Nigeria’s Naira as the worst performing currency of 2016 among more than 150 currencies worldwide.

Zambia doesn’t need a president; it needs an economic manager- this is when we are getting it. Good bless the economic team of HH, Musokotwane, Mutati, etc

Sipinya Ndongo – What do you think the job of a Finance Minister is? The President provides leadership and vision ..the Finance minister plots how to get there…PF in 2011 we had a not so educated President with ambitious vision who had no care how he was going to get there with a Finance Minster who was was from a bygone era afraid of advising otherwise as he was more interested in keeping his job and business interests.

An economic manager yes but not a dictator who imprison people on allegations of defamation. Such thin skinned people can’t manage anyone except livestock because animals don’t talk

Fake. Inflation is not reflecting what is on the ground. People are suffering and you guys are boasting of kwacha being the best performer against US dollar.

Tarino is the worst out of all the people that are suffering

I am sure its hurting you more that there is at least light at the end of the tunnel and your ignorance on these matters even makes you more angry…really laughable.

He is being kept in uk so he has no clue about the sad reality of many Zambians.

Sometimes its wise to read the whole article than rushing to comment like the two bloggers above!!

PRICES HAVE NOT COME DOWN IS THAT GOVERNMENTS FAULT OR THE BUSINESS COMMUNITY

TAXIS BUS FARES GROCERIES ETC ETC

I thought mention could be made of scaled up productivity in the agricultural and mining sector? How will the current gains be sustained? Agriculture, where are we going from here?

Some of us have gone through this before. In fact at the time the Kwacha was voted as the best performing currency in the world, Ronald Damson Siame Penza was simultaneously voted as the best performing Minister of Finance in the world and our poverty prevalence levels improved from an embarrassing 56% that UNIP & KK left it to 85%. That’s the time our Christian nation experienced a spiritual revival as Greeks and Lebanese unleashed their Alsatians on women for K500 a session. We’re just waiting to see what will happen this time around. I hope Situmbeko is a frontrunner in the world’s best Minister award

It also happened in 2017.

A best performing currency just means you have more forex. More forex which doesnt reach the street vendor, the kiosk owner, the ngwangwazi the peasant farmer. The currency is actually being shared by the very very few wealthy who want to access US markets for their own selfish ends. The rich will become richer and the poor will become poorer. Unless there is growth in industries like agriculture, manufacturing or beneficiation. Zambia currently has a sleeping construction industry, agriculture that needs intravenous feeding from govt, a dead Tourism industry and a mining industry that is expert at evading tax. Sorting these sectors out is what will make a succesful government

Yes Sakala you have a clever way of identifying Zambia’s sleeping potential. Any smart government would just need to work on the sectors you mention and benefits would trickle to the citizens. Chiluba did half heartedly attempt to do so but his wanting to imitate Western capitalism to the anus was suicide because investors are wolves not developers.

Fellow bloggers – take time to study basic economics to understand the dynamics economics prevailing in mother Zambia. I agree with Tarino Orange that some bloggers just rush to comment before they can read and comprehend what basically the article is all about.

SOME COMMENTS ARE NOT IN THE INTEREST OF ZAMBIA

BUT PURELY INTERPARTY RIVALRY

Keep up the good work Mr HH & Team. God bless Zambia

Its evident that zambia lost ten years of retrogress under corrupt pf regime headed by drunkard from chawama compound.

It is evident that you don’t handle constructive criticism well. It is a sign of weakness and small p.e.n.i.s

lost ten years of retrogress?? What is that?

Too many ignorant people are writing comments.

There is a saying, “ignorance is a misfortune, not a privilege”.

Remember that

Are you going to eat strong kwacha? Playing around with numbers at boz does not mean people at the bottom are getting a fair share.there is a disconnect between those at the top in upnd and the average Zambian

You do not understand economics. So that is forgiven. However, we will put it to you simply. Zambia imports nearly all inputs that go into products which are bought by both the rich and the poor. You cannot arrest inflation without managing the currency against import currency such as the USD. Expect product prices to fall as a result of this. The ability to import cheaply spurs economic activity, people can buy cars, people can buy inputs, people can buy clothes and other items for resale, of course, because the cost of importing is lower, the sales prices are lower. Next time, I will send you an invoice for free advice.

A strong local currency can chase investment because it becomes expensive to run businesses. The country will be compared to cheaper places and will lose out.

I think we need to guard our enthusiasm about the gaining in strength of our currency, the Kwacha. Any economists worth their salt will tell that what we are witnessing with regards to the strength of the Kwacha is what can be regarded as a SUGAR HIGH effect as a result of the promise and eventual approval of the IMF LOAN. The real test for the HH’s Administration will be seen in the months and years to come as to how they utilize the loan. It would also have been helpful if the conditions attached to the loan were made know. Are they in the similar mode of the SAPs (Structural Adjustment Programs) we have seen before? But, as always, IMF and its recipient Govt decides to operate in secrecy…..that doesn’t sound like “loan conditions” they are both proud of for Zambian citizens to…

Continue:

…see. And this, my friends, is why we should tame our enthusiasm about this loan. Taking a WAIT AND SEE at this juncture would be more wise!

Without a strong manufacturing base and adequately collecting enough tax revenue from the mines, this whole experiment and excitement will come crashing down sooner rather than later. Debt restructuring alone will and can NEVER be the magic bu!!et. And if currencies of stronger African economies such as S/Africa and Nigeria are struggling against the Dollar, what makes us think that the Kwacha stands a chance in the long run? And I hope the rise in the Kwacha is NOT being aided by some currency manipulations at the Central Bank…..because that will be the quickest way to tanking the little that still resembles a functioning economy in Zambia.

A strong manufacturing base requires cheaper inputs of materials, chemicals or whatever else. There is no currency manipulation, the currency has been controlled by monetary policy and demand-supply theories as there is excess USD and there will be more from the inflow from the IMF. That said, you raise a valid point. For this to be sustainable, it requires that the export side is resolved and the balance of trade is tilted. The largest exports are minerals and resolving KCM and Mopani is of paramount importance. Resolving the issues at these mines would immediately have a material impact on the economy.

Problem with Zambians is that we praise prematurely. Improvements in the exchange rate is manipulatablr, similar to how Russia managed this by forcing energy importers to pay in Rubles. I will start celebrating when unemployment rate hits single digits, people can afford at least 2 meals a day, infrastructure in good shape, fuel stabilizes, all mining companies start paying taxes, debt start declining, no corruption, etc. Right now, nothing to celebrate expecially that any money I send home is now squeezed and my beneficiaries worse off.

To say the Kwacha the best performer in the world is rubbish , The Kwacha is a blocked currency and thus is controlled and pegged by the Bank of Zambia and advise of the Govt. So being pegged the central bank can do what it wants, if they want to make the kwacha 1 to 1 with the USD they can. Where real trading world currencies are floated on the world market and then have a true value against the USD based on supply and demand and each countries financial policy.

@Cosmos that market is designed to enslave all of us forever. Our currencies cant compete on the open market. They need protection just as Trump and Biden protect or manipulate their currencies.

@ Yambayamba, Fotozoka, Ben you all have good points. These must be respected if we laymen have to understand what this noise is all about and how we will benefit.

Using foreign reserves to prop up the kwacha, notupuba tulelumba. Pa Zed bwafya sana.

No it isnt foreign reserves. Its foreign debt.

WHICH KWACHA ARE YOU TALKING ABOUT, MALAWAN, MAY BE PUND AND NOT HIS KWACHA MAYBE 1970S

Am disappointed this is coming from a learned president sure.

Imagine this stellar performance by HH against the 10yrs of PF declines and their “less money in our pockets in 10yrs” rather than the 90 day lie they sold to us.

Economics 101. INFLation is the speed at which prices are rising. When Lungu wasi power the speed was 24 km per hour. Now it is 9 km per hour. So, we were travelling FASTER towards being broke under Lungu, but now we are travelling slower. The COST of living is the point at which we have arrived on our money journey. So from Lusaka to Nakonde, we reached Kasama very quickly under Lungu, but now we are between Kasama and Nakonde travelling at a slower speed. We have still passed Kasama (High prices) and going to Nakonde (higher prices). For prices to come down, we have to turn back towards Kasama and back towards Lusaka.

This makes me understand inflation very well

@Dr Charles Ngoma…thanks for breaking it down so even us lay people can understand. Excellent analogy.

@Gatsby you full of points and wiser. WE NEED TO MAINTEN THE STRENGTH of Kwacha by importing more production EQUIPMENT AND be able to Export the produce

Local commodities are still high, the poor are getting poorer, i believe all will be better but the economic strategy for the this government has targeted the international level let them also fix the local level

@Its a balancing act

A strong local currency means cheaper imports and lower inflation and therefore lower production costs. The starting point is that Zambia needs a strong currency to build a manufacturing base. Once the manufacturing is developed then we can seek a weaker kwacha which will hoprfully help exports.

An example is Japan. It seeks a weaker Yen because it has a strong manufacturing base and is able to export a lot of stuff mainly vehicles.

Comments are closed.